Insurance Recovery Newsletter Vol. XXVI 2021

Table Of Contents

- Your 2021 Newsletter from Brouse McDowell

- Cyberattacks in 2021 Demonstrate Importance of Cyber-Risk-Insurance for 2022

- Tips for Managing Supply Chain Risks

- 2022 Ohio Supreme Court Update

- Utilizing Representations and Warranties Insurance in M&A Transactions and Related Financing

- Maximizing Coverage for Government Investigations

- Attorney Highlights

Your 2021 Newsletter from Brouse McDowell

The past year has been a busy one for Brouse McDowell’s insurance recovery practitioners. An evolving workplace model and ongoing fall-out from the COVID-19 pandemic have continued to impact the insurance market, including the types and frequency of insurance claims. More than ever, policyholders are seeking our counsel to assist them in selecting and purchasing insurance coverage that will shift the risks of their enterprise and function in the manner contemplated at the time of purchase.

The importance of understanding the coverage being purchased before a loss or injury occurs has been highlighted, in no small part, by the experience many companies have had with insurance claims related to COVID-19. The news is flooded with stories of policyholders whose claims have been unexpectedly denied by their insurers. Of course, business interruption coverage for COVID-related losses is still a hotly litigated issue, in both federal and state courts nationwide. Our insureds also continue to demand that insurers honor their obligations under other types of policy coverages—communicable disease, environmental, and event cancellation. Until state supreme courts decide many of these issues, however, coverage for COVID-19 losses is likely to continue to be contested.

Brouse has also seen several of its clients shift their business models to permit, or even require, regular remote work. This fact, and the evolving nature of cyber risk, highlighted in this newsletter, have made procuring sufficient cyber insurance coverage more critical than ever. For some, though, obtaining comprehensive cyber coverage at reasonable premiums has been a challenge. This is also true in other markets, including directors & officers and property & casualty.

Rising risk awareness, the pandemic, increasing natural disasters, stock market volatility, and an unprecedented number of insurance claims have created a “hard” insurance market. This impacts policyholders in several ways. In underwriting, insurers are likely to raise premiums, reduce the number of policies they issue, refuse to insure certain risks, and narrow the scope of coverage. With respect to claims, insurers are likely to deny claims with more frequency and are less likely to negotiate reasonable resolutions of disputed claims with their insureds.

Brouse McDowell has been assisting our clients with their insurance coverage needs for decades—in both soft and hard markets—from working with insurance brokers to understand and negotiate policy terms, to advocating zealously for our clients when claims are wrongfully denied. In this issue, we discuss some things on the horizon, as well as issues facing our corporate clients with increasing frequency.

Share Article Via

Cyberattacks in 2021 Demonstrate Importance of Cyber-Risk-Insurance for 2022

Craig S. Horbus, Jarman J. Smith

As cyber-related incidents continue to grow in number, we are advising companies to place even more emphasis on Cyber Risk Coverage for 2022. The volume of new clients seeking out representative breach counsel regarding cyber-attacks grew immensely in 2021. As a result, Brouse has been called to action in an expanded capacity. From this firsthand experience, we have observed the need for many businesses and organizations to prioritize cyber-risk insurance coverage to contain their liability in the event of a cyber-incident. Along with prioritization comes scrutinization of the policies and the coverage being provided. As companies and policyholders alike increase their awareness of digital threats and their knowledge of coverage-related issues, the cyber-risk insurance industry is being called upon to provide not only an increase in coverage, but also adequate, or even new coverage, in historically weak areas to help ease liability concerns resulting from an alarming number of cyberattacks that wreaked havoc throughout 2021.

Cyber-Risk Insurance Essential to Addressing Cyberattacks

We can expect another increase in cyber-related attacks this year. Cyber-related impact events such as ransomware and data breaches continue to remain our number one focus as we head into 2022. Looking back at 2021, the Identity Theft Resource Center reported that the number of data breaches in 2021 surpassed 2020’s figure even with three months remaining in the year.1 As the tactics of cybercriminals continue to evolve and become more sophisticated, we can anticipate that the number of data breaches in 2022 will be even higher than the numbers in 2021. So how can organizations best protect against cyber risks in the year ahead? By prioritizing cybersecurity companywide, including compliance and incident response planning, along with obtaining a comprehensive cyber-risk insurance policy, companies will be ahead of the curve when it comes to mitigating damages of an inevitable attack.

Cyber-risk insurance can be thought of as a collection of coverages that protect your company from a variety of incidents, including data breaches, ransomware attacks, digital destruction, and the resulting damages of the foregoing. A comprehensive cyber-risk policy will likely include more than a few separately identified coverage options, but there are four essential coverages that we would advise all companies to carry to protect your interests during a cyber incident.

Extortion Coverage

Extortion coverage operates as ransomware recovery support. It can provide monetary reimbursement if your organization is forced to pay a ransom to regain access to compromised systems and/or for the return of stolen data. If properly obtained, this coverage may also cover the cost of hiring professionals, such as competent legal counsel, to negotiate with the cybercriminals on your behalf. In 2021, the average ransomware payment increased by 82%. A ransom demand can be crippling for many businesses and can provide a swift ending to many small businesses. With an increase in attacks in 2021, it’s more important than ever to build up your defenses in anticipation of a cyber event. Now is the time to ask your professional team to do a complete cyber-risk audit to uncover any gaps in your cybersecurity protocols.

Business Interruption Coverage

Business interruption coverage is designed to compensate you for the loss of income that results from the downtime your organization may face after a cyber incident. If your system or network was paralyzed, corrupted, or otherwise made inaccessible as a result of a cyberattack, your business could come to an abrupt halt. And when operations are down, lost revenue is a certainty. Business interruption coverage can cover expenses you incur related to your efforts in restoring your operations.

Data Loss/Data Restoration Coverage

Data restoration coverage is designed to cover the costs of replacing or restoring compromised data resulting from a virus, ransomware, or another form of cyber incident. Most businesses would like to act with urgency to quickly and fully recover their data after a cyberattack. Doing so can reduce downtime and can help restore trust in your business.

Incident Response Coverage

Incident response coverage covers expenses related to the various expert services that your organization may need to remediate the effects of a cyber incident, to restore security protocols and prevent future security issues. For instance, a data breach can require a thorough investigation by a computer forensics team to determine the breach cause and prevent future occurrences. You will also need to enlist the services of competent cyber legal counsel and— depending on the level of breach— you may need a public relations firm, and consumer ID monitoring and notification specialists.

How Brouse Can Help

Ransomware and other cyber-related incidents will likely remain the number one threat to companies in 2022. Organizations must be prepared to do everything they can to mitigate the damage of an inevitable attack. We advise having cyber legal counsel conduct a review of your existing policies and protocols in place to ensure compliance with all data privacy laws and regulations, revise and update those that need attention, review existing insurance and fill any gaps to obtain appropriate levels of cyber-risk insurance to further reduce exposure to cyber-related risks. Cyber-risk insurance is complex, and it may leave many confused as to what adequate coverage looks like. Failing to obtain the right coverage could leave your organization exposed to substantial risks in the event of a cyber incident. It is important to have assistance from competent professionals as you analyze your security and seek to obtain cyber coverage. Brouse McDowell’s Insurance Recovery and Cybersecurity & Data Privacy teams can provide the guidance and tools you need to defend against cyberattacks, protect consumer information and obtain proper cyber-risk insurance coverage. Please contact us for more information and to learn how we can partner with you.

1See https://www.propertycasualty360.com/2021/12/29/cyber-insurance-in-2022-a-year-for-collaboration/.

Share Article Via

Tips for Managing Supply Chain Risks

Joseph K. Cole, Lisa M. Whitacre

Anyone who has purchased, or tried to purchase, a new vehicle, a bicycle for their child’s birthday (speaking from personal experience), certain electronics or appliances, or other high demand products or services has likely experienced the effects of global supply chain disruptions causing businesses both big and small to struggle to meet demand or even continue operating. The reasons for these disruptions are complex and multi-faceted, but there is little doubt that the global pandemic has and continues to play a significant role. Some predictions however, anticipate that supply chain disruptions will continue for the next year or more and could outlast the global pandemic.

So how does a business manage supply chain risks? One tool is insurance. Below are four tips for maximizing insurance as a strategy for managing supply chain risks.

Know and Understand Your Policies

A policyholder may have a number of different types of policies that cover different losses, including:

- Business interruption (BI) coverage that covers a policyholder’s lost profits if the policyholder’s operations are interrupted due to a covered peril. BI insurance provides coverage for lost earnings and may also cover expenses like rent, utilities, and employee wages.

- Extra Expense Coverage that covers certain additional expenses in excess of normal operational costs that a policyholder may incur, enabling the policyholder to continue operations while its property is repaired or replaced after a covered loss.

- Contingent Business Interruption (CBI) insurance helps cover a policyholder’s financial losses related to disruptions of a covered supplier, partner, manufacturer, or major customer that negatively impacts a policyholder’s ability to operate.

- Supply chain coverage is a specialty “all risk” insurance designed to protect policyholders from a failure in their supply chain.

- Other specialty insurance and manuscript policies – there are other specialty insurance products available in the market, and many businesses, particularly larger businesses, negotiate manuscript policies that are tailored to meet their specific needs.

The specific terms, exclusions, and endorsements in these policies vary greatly. For example, BI and extra expense coverage often, but not always, require physical loss or damage to covered property. These policies typically cover the policyholder’s property (as opposed to a supplier or customer) and therefore will not cover losses arising out of physical loss or damage of a supplier’s property or facility. CBI insurance, which would cover a supplier or customer, may also require physical loss or damage; however, many CBI policies, particularly foreign ones, do not have such a requirement.

For policyholders seeking coverage because of disruptions related to COVID-19 and related government shutdown orders, policies without a physical loss or damage requirement are more likely to provide coverage.

Whether there is coverage under policies with a physical loss or damage requirement is dependent on whether a “physical loss” has occurred. Courts across the country have struggled with that question reaching differing results. The Ohio Supreme Court is expected to address the issue this year in Neuro-Communication Servs., Inc. v. Cincinnati Ins. Co., No. 2021-0130. Another important consideration is whether the policies have a virus/bacteria exclusion and whether the policies include or exclude communicable disease coverage. Knowing which policies you currently have and understanding what they cover is critical.

Know and Understand Your Supply Chain and Identify Potential Coverage Gaps

Understanding the ins and outs of your supply chain is also critical in managing the risks associated with it. A small business transacting locally or even within the continental United States is less likely to run into the same sorts of risks as organizations with complex supply chains, international suppliers, or suppliers in politically unstable areas, and those differences help determine whether CBI, supply chain, or other specialty coverage makes sense for your business.

- Where more complex coverage is warranted, it is important to take a hard look at your supply chain. Here are a few questions to consider:

- Should just the first tier of suppliers or the entire supply chain be covered?

- Are there certain products or materials where no viable alternative supplier is available?

- Are there suppliers or customers that are critical to the continued operations of your business?

- Are there unique risks associated with your business that justify obtaining a manuscript policy specifically tailored to those risks?

These considerations must be balanced with the cost of obtaining additional coverage. The takeaway is that there isn’t a one size fits all approach when it comes to managing your supply chains risks.

Identify Current Disruptions

Navigating an existing disruption can be harrowing, though pinpointing the precise location and, sometimes, like in today’s supply chain, multiple locations of the disruption can reveal coverage triggered under one or more existing policies. For example, your business may experience disruptions related to a government order requiring a first-tier supplier to shut down while at the same time, a second-tier supplier may be experiencing staffing shortages and production delays. On top of that, necessary materials or parts may be delayed at sea. Fully understanding each of these unique disruptions in the whole of your organization’s supply chain will be invaluable in assessing potential coverage.

Document all Potentially Covered Losses

Get in the habit of documenting all losses, including those you believe are covered and those you’re not so sure about. As the pandemic and supply chain disruptions continue to wreak havoc, economic risks and the legal landscape continue to evolve. Whether a claim is covered depends on the specific terms, exclusions, and endorsements of your policies, all of which are interpreted by our courts in light of the circumstances of the claim. What you assume is an uncovered loss, could, in fact, be covered by one or more policies.

Share Article Via

2022 Ohio Supreme Court Update

The way most general liability insurance policies are structured is that they start off with a very broad coverage grant, applying to all damages that the insured becomes legally obligated to pay because of bodily injury or property damage caused by an occurrence. An occurrence, in turn, is defined broadly as an “accident, including continuous or repeated exposure to substantially the same general harmful conditions.”

After this broad coverage grant, the policy will usually include a battery of exclusions that narrow the coverage.

So, following this broad structure, a typical insurance policy will give with one hand (the coverage grant) and take away with the other (the exclusions). And because the coverage grants are traditionally so broad, for most first-party and third-party risks, the question of coverage comes down to the exclusions—that is, whether the other hand took away what was given in the coverage grant.

But now, in a pair of insurance cases pending before the Ohio Supreme Court, insurers are attempting to subvert this usual structure. Instead of focusing on whether the exclusions apply, they argue that the risk does not fall in the broad coverage grant in the first place. It does not matter, according to these insurers, whether the exclusions took away coverage because as they argue, it was never given in the first place.

In Motorists Mutual Ins. Co. v. Ironics, Inc., the policyholder sold defective tube scale to its customer. Tube scale is a product used to make glass bottles. Because the tube scale was defective, the resulting glass bottles were unusable. The policyholder’s customer demanded to be reimbursed for the damage. The policyholder, in turn, tendered the claim to its insurer, who denied the claim.

Now, most liability policies have an exclusion for damages to “your product”—meaning the insured’s product. This makes sense, since liability policies in general cover damage to third-party property, not the policyholder’s property. (Those sorts of losses are covered by first-party insurance, which is subject to its own slate of exceptions.)

In Ironics, though, the policyholder has a strong argument that the exclusion for damages to “your product” did not apply. This is because the ultimate damage was not to the policyholder’s product—the tube scale—but to its customers product—the glass bottles.

The insurers in Ironics disagreed with this interpretation of the exclusion, arguing that it applied to the glass bottles because they were integrated products, such that the glass bottles were inseparable from the tube scale. But the insurers also went further, questioning the premise of whether the loss was insured in the first place.

According to the insurers, regardless of whether the “your work” exclusion applied, the loss was not covered because it was not “fortuitous.”

The Ohio Supreme Court first invoked the “doctrine of fortuity” in Westfield Ins. Co. v. Custom Agri Sys., Inc., 133 Ohio St.3d 476, 2012-Ohio-4172, 979 N.E.2d 269, a case holding that liability insurance does not generally cover damages for claims of alleged defective construction and workmanship to the insured’s own work. The Ohio Supreme Court held that—to count as “property damage” caused by an “occurrence”—the damage had to be fortuitous.

But it was not clear from Custom Agri what the so-called fortuity doctrine added to the traditional analysis. It was always the case that general liability policies applied only to accidental damage. So, it was never clear what a fortuity element added. It seems incoherent to say that a loss could be accidental but not fortuitous. But, if this is what the Ohio Supreme Court was holding—i.e., that there were non-fortuitous accidents—how were policyholders supposed to tell the difference? And what basis was there in the policy language to distinguish between different types of accidents, fortuitous on one side and non-fortuitous on the other, when the language of the coverage grant applied to all accidents?

These distinctions were never fully addressed in Custom Agri or in subsequent cases. Predictably, then, in later cases, such as Ironics, insurers seized on the “fortuity” doctrine, arguing to expand it to preclude coverage for even more types of accidental losses. The whole project, though, is only possible if insurers are permitted to introduce new concepts such as an ill-defined “fortuity doctrine,” in the coverage grant, where they don’t belong.

What’s more, once the insurers got a taste for adding restrictions into the coverage grant, they did not stop with the fortuity. In Acuity v. Masters Pharmaceutical, for example, another case pending before the Ohio Supreme Court, the insurers are arguing the term “legally obligated” in the coverage grant applies only to tort liability.

The policyholders in Acuity are manufacturers and distributors of opiates. The insureds were sued by local and state governments claiming they had to pay increased costs for medical and police services, among others, as a result of the opiate epidemic. The governments are seeking to recover against the manufacturers and distributors based on their role in setting off the epidemic.

The policyholders tendered the government’s claims to their insurers, which denied the claims for a number of different reasons. Most relevant here, the insurers argued that the claims were not covered because the governments’ claims were for economic damages, not direct tort liability for bodily injuries. As such, according to the insurers, the losses were not covered because the terms “legally obligated to pay as damages” in the coverage grant “clarifies that [to be covered] the insured’s obligation must arise from the breach of a non-contractual duty.” (Appellant’s Reply Br. 6.) So according to the insurers, the coverage grant is restricted to traditional tort liabilities.

As an initial matter, it is not clear that this supposed tort restriction on the coverage grant would have any bearing on the policyholder’s claims in Acuity. After all, the governments are not suing the policyholders for breach of contract. They are suing in tort. So even if the insured’s purported tort restriction existed, it wouldn’t preclude coverage in Acuity.

More importantly though, for our purposes, there is no tort restriction in the coverage grant. The policy applies to damages that the insured is “legally obligated to pay as damages.” The insurers argue that this phrase applies only to non-contractual duties But they provide no compelling reason for this proposed restriction. The language does not say “legally obligated in tort.” As such, it applies to all legal obligations. And it should not be a matter of great controversy that contractual obligations are, in fact, legal obligations (though the insurers’ confusion on this point is perhaps more telling than they realize).

Both of these cases—Ironics and Acuity—demonstrate a coordinated effort amongst insurers to restrict the coverage grant beyond what is warranted by the language in the policy. Policyholders and the courts should resist these efforts. Every policy gives coverage in one hand and takes it back in the other. But the takebacks should happen in the text of the policy. And if the insurers didn’t take back coverage in their exclusions, the courts shouldn’t do it for them.

Share Article Via

Utilizing Representations and Warranties Insurance in M&A Transactions and Related Financing

Molly Z. Brown & TJ Noonan, Hylant

Merger and acquisition (M&A) transaction participants are increasingly using representations and warranties (R&W) insurance to provide coverage for breaches of R&W in purchase agreements. In the last few years, R&W insurance has become a commonplace insurance product and a mainstay component of private M&A transactions north of $50 million.

We spoke with insurance broker Hylant’s T.J. Noonan, Managing Director, Transactional Risk, who specializes in placing R&W insurance. According to Noonan, current policy limits range from $3 million up to $1 billion. Typically, this equates to deal sizes of $20 million to $10 billion, with deals between $50 million and $500 million being the most common. Noonan confirmed 2021 underwriting activity for M&A transactions for less than $30 million. In these deals, buyers obtain a higher proportion of coverage to the deal value (i.e., greater than 10%), with minimum out-of-pocket costs for a buyer ranging from $160,000 to $200,000, for a $3 million limit.

An R&W insurance policy protects an insured against financial loss— including defense costs— resulting from breaches of such R&W, and in certain cases covers indemnification in the purchase agreement. This type of insurance can be used by public and private entities, in both change of control situations and non-control minority investments. In addition to the standard exclusions discussed below, R&W insurance does not cover breaches in covenants in the purchase agreement.

Policies Can be “Seller Side” or “Buyer Side”

R&W insurance can be purchased as either “Seller Side” or “Buyer Side” coverage.

Seller Side policies serve as a liability policy providing coverage to the seller for its liability for claims for breach of R&W in the purchase agreement made to the buyer. This type of policy would pay the seller as named insured, not the buyer. By comparison, a “Buyer Side” policy is a form of first-party coverage that allows the buyer to be compensated directly by the insurer. A common added variation to “Buyer Side” policies also protects the seller by preventing the insurance company from seeking recovery from the seller except in cases of fraud. We highly recommend this variation be explored for our clients that are sellers.

When Hylant assists its clients in obtaining R&W insurance, the named insured is often the buyer in the transaction, with lenders providing acquisition financing as additional insureds. By having the buyer and lender as named insured and additional insured, respectively, they can be paid directly from the insurer. This mitigates any collectability issues or controversy presented, which is desirable in distressed transactions or transactions with more than a single selling shareholder. In the event of a breach of any R&W in the transaction, after accounting for the retention, the insured would receive a payment to offset their loss up to the maximum policy limits.

Introducing R&W Insurance in the Deal

Sellers utilizing an investment banker led competitive bid or auction process often stipulate R&W insurance as a bid qualification and a means they are proposing to avoid an escrow. By comparison, buyers seek R&W insurance when indemnity is limited or absent, or when escrow is not able to be obtained. Since indemnity provisions are often the most negotiated section in purchase agreements, R&W insurance provides a mechanism for parties to bridge the gap by shifting risk of breaches in R&W made by the seller and the collectability of indemnity to an insurer in exchange for a policy premium by providing the buyer, as the named insured, the ability to collect from the insurer. Banks and other lenders providing credit are increasingly requiring R&W insurance as a condition of term sheets and a means to shift risk. The following table provides a summary of the benefits available to buyers, sellers, and lenders.

Policies are Deal-Specific

R&W insurance is unique in that it is fully customizable and negotiated on a deal-specific basis. Policy limits typically range between 10-20% of the enterprise value of the transaction with retentions set at 1% to 3%. Premiums typically range from 3.5-5% of the policy limits. Because of the time-intensive underwriting, insurers are less motivated by deals below policy limits of $3 million and charge underwriting fees of $15,000 to $40,000.

Insurance capacity for the R&W product is robust comparable to other areas in the insurance market. Capacity in this relatively new market continues to be positively affected by insurers attempting to enter this market.

Recognizing Limits of Risk Transfer

Buyers need to recognize that R&W insurance, while a means to transfer risk from the buyer’s balance sheet, does not provide as broad of coverage as a seller escrow of the same size. For example, R&W insurance does not provide coverage for covenants and special indemnities provided in transactions or information disclosed in due diligence. Buyers also need to account for premiums, retention, and underwriting fees for R&W insurance that the buyer will pay as part of their deal models.

Likewise, each insurer’s policy will be different, and it is important to read and know the differences before procuring the product and to tailor those to the policyholder’s needs and the circumstances surrounding the deal. Many R&W policies contain the following exclusions:

Hylant’s Noonan explained that industry norm is that retentions are cut by 50% after year one. This is primarily driven by the fact that 66% of claims (greater than $1 million) are reported within the first year, according to AIG’s Claims Intelligence Series. See AIG Claims Intelligence Series: M&A: A rising tide of large claims, at page 4 (available at www.aig.com/business/insurance/mergers-and-acquisitions/mergers-and-acquisitions-claims-reports (visited Feb. 18, 2022)). Because this is a customizable product, policies often have a step down of the retention after the expiration of any indemnities provided by the seller under the purchase agreement.

Underwriters are also known to provide coverage for pre-sale tax indemnities covered in the purchase agreement. Certain fundamental representations may be able to obtain nil retention if made as part of the transaction related to authority to conduct the transaction, ownership of shares, and no brokers other than as listed on disclosure schedules.

Underwriting Process

The underwriting process is becoming increasingly more stringent. Required information serving as the foundation for the underwriting process includes:

- draft purchase agreement,

- offering memorandum,

- any documents describing target’s business,

- a copy of recent financial statements, and

- existing due diligence reports and data room information.

Insurers will also expect to participate in conference calls with the insured’s deal team. Typically, audited financial statements and a quality of earnings report from a qualified external CPA are required before binding of coverage by underwriters. This last requirement can take eight (8) weeks or more.

Due diligence trends related to enforcement of matters on regulators’ radar, past litigation history, environmental concerns, and long-term liabilities are always key concepts that underwriters are keen to address. According to Noonan, employment-related claims such as independent contractor vs. employee classification continue to receive increased focus from underwriters.

How Brouse Attorneys Can Help

Because of the unique nature of the underwriting of this risk, it is important for purchasers of R&W insurance to have a trusted adviser helping them to negotiate terms of the policy and to ensure it is customized to meet their objectives. Brouse attorneys are experienced in negotiating terms of R&W insurance and in serving as liaison with insurers for companies involved in transactions. Our insurance team is accustomed to augmenting our firm’s deal lawyers to facilitate obtaining insurance, negotiating on exclusions, the closing of deals, and working with our clients’ deal lawyers at other firms to ensure the best coverage possible is obtained. Should you need help with M&A insurance due diligence, please do not hesitate to reach out.

R&W Insurance Benefits

|

Buyers |

Sellers |

Lenders |

|

• Adds protection to indemnity cap and survival periods |

• Provides backstop or replaces negotiated indemnity |

• Offers longer term than reps and warranties in purchase agreement |

R&W Insurance: Standard Policy Exclusions

- Asbestos/PCB

- Healthcare Billing and Coding

- Criminal Fines and Penalties

- Net Operating Losses

- Insured’s Actual Knowledge at Binding of Coverage

- Pension Underfunding/Withdrawal Liability

- Medicare/Medicaid Reimbursement Risks

- Post-closing Purchase Price Adjustments

- Transfer Pricing

Share Article Via

Maximizing Coverage for Government Investigations

The Biden administration and government agencies have indicated that in 2022 companies will see an increase in investigations, regulatory oversight, and enforcement actions by the U.S. Securities and Exchange Commission (SEC) and Department of Justice (DOJ). Specifically, government agencies have stated that they intend to take an aggressive approach regarding anti-corruption and compliance, failure of entities to maintain adequate cybersecurity practices and controls, regulation and compliance surrounding cryptocurrencies, environmental investigations and enforcement, and climate disclosures and risk.

Typically, the government’s first step is an investigation, which involves letters requesting information, subpoenas, civil investigative demands (CIDs), or formal orders of investigation. Investigations require engaging experienced counsel, reviewing and producing documents, preparing and conducting witness interviews and testimony, and responding to numerous inquiries. They can be disruptive and expensive. That’s why it is imperative that companies re-examine their insurance policies and take steps to maximize coverage.

Coverage often depends on whether subpoenas, CIDs or other documents issued as part of governmental investigations, constitute a “claim” alleging a “wrongful act” as defined by your D&O, E&O, or professional liability policies.

Do I Have a Claim That Can be Covered?

What constitutes a claim can vary greatly between policies. Some policies only cover “regulatory investigations commenced by formal orders of investigation,” while others expressly exclude “investigations of an organization.” These narrow definitions are problematic to obtaining coverage if the government agency merely issues a letter requesting information – albeit one the company cannot ignore. Other policies, which define a claim to include “investigations of the Insured related to a Wrongful Act” or for costs associated with responding to “informal information requests”, are more likely to provide coverage.

Does the Government’s Investigative Document Allege a Wrongful Act?

A wrongful act is typically defined broadly to include an actual or alleged breach of a duty, neglect, error, misstatement, misleading statement, omission, or act by the policyholder. Insurers argue that a subpoena or CID does not and cannot “allege” a wrongful act, but merely ask for documents or testimony. Some courts have agreed with insurers. See, e.g., MusclePharm Corporation v. Liberty Insurance Underwriters, Inc., 712 Fed.Appx. 745, 754 (10th Cir. 2017). However, other courts examine the subpoena or CID more carefully to determine whether it, or the letter accompanying it, alleges violations of law or statute. The Delaware Superior Court held that a CID which stated the government was investigating possible Medicaid fraud and activities, does allege a Wrongful Act. Conduent State Healthcare, LLC v. AIG Specialty Ins. Co., No. CVN 18C12074 MMJCCLD, 2019 WL 2612829, at *6 (Del. Super. Ct. June 24, 2019). Increasingly, SEC subpoenas, tolling agreements, and CIDs include language where the government expressly states that there is a possible violation of various federal criminal statutes and, thereby giving policyholder’s the argument that the document does allege a Wrongful Act and coverage should be afforded.

Coverage often turns upon the specific definitions in your policy, the types of documents issued by a government agency, types of proceedings initiated by the government, and geographic locations of the dispute. With an increase in investigations on the horizon, companies should waste no time in re-examining policy terms and attempting to negotiate more favorable terms if necessary.

If an investigation begins, timing and tenacity could mean the difference between a covered and uncovered claim. Policyholders should take steps to maximize their coverage for these investigations.

Steps to Maximize Coverage for Government Investigations

- Upon notice of a government investigation or receipt of a subpoena, CID, or similar document: contact the person responsible for insurance—risk manager, general counsel, broker, or outside counsel—to examine and evaluate claims of coverage. With the ever-changing law, complexity of investigation, and differing policy language, be cautious that coverage is often misunderstood; bad advice can cost you.

- Gather all applicable policies – D&O, E&O, EPLI, and professional liability policies.

- Review all policies. Analyze what constitutes a claim; what constitutes a Wrongful Act; and who qualifies as an Insured.

- Strictly follow the notice requirements. When in doubt, provide notice. Some claims require immediate notice. Some policies may require notice when the insured has knowledge of potential claims, Wrongful Acts, or related acts. Demand an immediate defense in the notice letter.

- Actively pursue coverage.

- Respond to all mischaracterizations of fact and coverage.

- Keep the insurer apprised of the investigation.

- Engage insurance recovery counsel, if needed, to enforce your rights under the policy(ies).

Share Article Via

Attorney Highlights

Accolades

The Insurance Recovery Practice was recognized for the second year in a row by Chambers USA 2021 in Band 1 for Insurance: Policyholder (Ohio) and Stacy RC Berliner, Lucas M. Blower, Amanda M. Leffler, Andrew W. Miller, and Paul A. Rose were ranked as leading practitioners.

The Insurance Recovery Practice was recognized by U.S. News – Best Lawyers’ “Best Law Firms” 2022 in Tier 1 for Insurance Law (Akron, Cleveland, and Fort Myers) and Tier 1 for Insurance Litigation (Akron).

Recognized by The Best Lawyers in America 2022 – Christopher J. Carney, Clair E. Dickinson, Amanda M. Leffler, Joseph P. Thacker, and Richard S. Walinski for Commercial Litigation; Stacy RC Berliner, Lucas M. Blower, Amanda M. Leffler, Paul A. Rose, and Joseph P. Thacker for Insurance Law.

Joseph K. Cole and Nicholas J. Kopcho noted as “Ones to Watch” by The Best Lawyers in America 2022 for Insurance Law.

Recognized by Ohio Super Lawyers 2022 – Stacy RC Berliner, Lucas M. Blower, Amanda M. Leffler, and Paul A. Rose for Insurance Coverage; Christopher J. Carney, Kerri L. Keller, Nicholas J. Kopcho, P. Wesley Lambert, and Richard S. Walinski for Business Litigation.

Recognized as Rising Stars by Ohio Super Lawyers 2022 – Alexandra V. Dattilo for General Litigation and Nicholas J. Kopcho for Business Litigation.

Joseph K. Cole received the UToledo Emerging Leader Award from the University of Toledo College of Law.

David Sporar recognized by Who’s Who in America for 2021.

Publications & Media Mention Highlights

Stacy RC Berliner and P. Wesley Lambert noted in Law360’s article “Three Insurance Appeals To Watch At State High Courts in March.”

Stacy RC Berliner and Amanda M. Leffler presented for the northeast Ohio Chapter of RIMS on “Shifting Risk: Drafting Contractual Insurance and Indemnity Provisions to Provide the Protection you Contemplated.”

Andrew W. Miller spoke at an OSBA CLE program titled “National Developments in Insurance Coverage: A Year in Review.”

Amanda M. Leffler and P. Wesley Lambert noted in Westlaw and Law360 regarding first-of-its-kind in Northern District of Ohio Zoom jury trial resulting in a successful verdict for client.

Joseph K. Cole wrote a blog “COVID Coverage Cases Turn on Policy Language.”

Brandi L. Doniere and Amanda M. Leffler presented at Strafford Publication’s Virtual CLE titled “GC’s Role in Remote Work Legal Issues: Data Governance, Privacy, Automating Documentation, Employee Communication.”

Anastasia J. Wade wrote a blog “Reimburse Your Insurer? Look to the Recent Decision by the Nevada Supreme Court.”

Jarman J. Smith wrote a blog “Recent Cyberattacks Complicate Cyber Insurance Industry and Coverage.”

Joseph K. Cole noted in Law360’s article “Policyholder Attys Eye Ohio Justice’s Role In COVID-19 Fight.”

Paul A. Rose noted in Law360’s article “Drug Co. Owed Defense In Opioid Suits, Ohio Justices Told.”

Joseph K. Cole and Lisa M. Whitacre wrote an article for the Cleveland Metropolitan Bar Journal titled “Managing Supply-Chain Risks Through Insurance.”

Appointments & Promotions

Stacy RC Berliner named Co-Chair of the firm’s Insurance Recovery Practice in January 2021.

Stacy RC Berliner named Co-Chair of the Insurance Law Section of the Cleveland Metropolitan Bar Association.

Joseph K. Cole selected to serve on the Screening Committee of the Ohio State Bar Association Council of Delegates for 2021-2022.

Share Article Via

Insurance Recovery Newsletter Vol. XXV 2020

Table Of Contents

- Your 2020 Newsletter from Brouse McDowell

- Insurance Coverage for Losses and Claims Arising From COVID-19

- “Late” Notice? Remain Calm; All May Be Well.

- Year in Review: 2020 Non-COVID Related Decisions from Across the Country

- A Fixed Attachment Point: Excess Insurer to Pay Long-Tail Claims Exceeding Policy Limits

- Contaminants of Emerging Concern and Insurance Coverage

- Ohio Court Recognizes Coverage for Opioid Claims

- Ohio Supreme Court Preserves Policyholder Allocation Rights

- Ohio Court Rules in Policyholder’s Favor on Scope of Pollution Exclusion & Settlement Credits

- What to Expect When You Are Renewing

- Attorney Highlights

Your 2020 Newsletter from Brouse McDowell

Amanda M. Leffler, Lucas M. Blower

It goes without saying that 2020 has been filled with substantial change, rampant uncertainty, and unexpected challenges for nearly every one of our clients and friends. Like all of you, our firm has seen first-hand the wide-ranging effects of the COVID-19 pandemic on businesses. Together with the movement to fight social injustice and the impact of the presidential election, 2020 will unquestionably have a lasting and historic effect on our economy, in both the short and long-term.

The insurance market, likewise, has not been immune to the “new normal.” Insurers and policyholders affected by the pandemic have been litigating throughout the year over whether there is insurance coverage when an entire economy shuts down. Amanda M. Leffler, in her article Insurance Coverage for Losses and Claims Arising from COVID-19, discusses these cases and the prospect for policyholders recovering under their property, liability, and other policies.

We expect that many of these issues will be resolved in 2021 at the earliest. This uncertainty is just one of the factors contributing to a hardening insurance market. In her article What to Expect When you are Renewing, Stacy RC Berliner addresses these changes in the market and shares practical tips for your next renewal.

Meagan L. Moore, in her article Contaminants of Emerging Concern and Insurance Coverage, addresses an issue that will become potentially more prominent in a Democratic administration. She discusses coverage for environmental liabilities arising out of historically unregulated constituents not previously classified as hazardous under federal or state laws.

Of course, even in times of change, some things are constant. And, in 2020, like in other years, insurance claims, particularly large insurance claims, were denied with some frequency without evident or appropriate regard by insurers for their merit. In articles written by Andrew W. Miller, P. Wesley Lambert, Jodi Spencer Johnson, Lucas M. Blower, and Paul A. Rose, we discuss significant decisions rendered by courts—both in Ohio and nationally—where policyholders have prevailed against insurers that have wrongfully denied valid claims.

As we look forward to the next year, we expect that many of these issues will continue to arise in disputes between insurers and their policyholders. The attorneys at Brouse McDowell, as always, are committed to both informing and protecting policyholders in Ohio and throughout the nation.

It is our sincere hope that you find this newsletter useful.

Share Article Via

Insurance Coverage for Losses and Claims Arising From COVID-19

COVID-19 has impacted nearly every aspect of our lives, resulting in catastrophic losses and prospective liability for businesses of every size across the globe. Over the past nine months, our firm has counseled clients, brokers, and friends, helping them navigate the complex world of insurance to answer the question keeping them up at night: is my business going to be covered for all of this?

As with nearly any insurance claim, the answer to that simple question depends on the specific language of your insurance policy and the unique facts applicable to your claim. Some trends have developed since the pandemic began, however, and new issues continue to emerge as employees head back to the office and stakeholders consider ways to recoup their own losses. These trends and issues are discussed below.

Business Interruption Insurance

By this point, nearly everyone has heard of business interruption insurance—the first-party coverage that is provided with some, but not all, property policies. This insurance is designed to indemnify the insured for lost profits when its business is unable to operate as a result of an unforeseen event. When the pandemic forced countless businesses to close their doors or severely restrict their operations, numerous insureds turned to their insurers for relief. In virtually every case, though, the insurers denied these claims.

Insurers identified several bases for their denials: (1) that the policy only covers damage to, or destruction of property, which doesn’t exist in the context of coronavirus claims; (2) that, even if property damage exists, it didn’t cause the insured’s loss of income (i.e., the insured didn’t close because of property damage, but to limit the spread of the virus); and (3) that viral/bacterial exclusions preclude coverage in any event. In response, thousands of insureds in nearly every state filed lawsuits against the insurers. The insureds noted that there are multiple cases which have found coverage under similar circumstances, i.e., cases where courts have held that property can sustain “physical damage” even if it hasn’t suffered “structural alteration.”

Only a handful of these cases have been decided. While most cases remain pending, several trial courts have dismissed claims, generally on the grounds that the insured failed to plead that it suffered any “direct loss or damage” to the insured premises. These dismissals have made one thing clear—hiring experienced insurance counsel is critical. Many sophisticated insurance commentators agree that at least some of these cases would not have been dismissed if they had been pled to more clearly fall within the coverage of the policy. Of course, these cases are subject to appeal and, more recently, we’ve seen a handful of trial courts affirmatively deny insurers’ attempts to avoid their coverage obligations for business income losses. Simply put, we are quite early in the development of the case law on coverage for COVID-19 losses, and whether there will generally be coverage for these losses remains undecided in every jurisdiction.

In addition to the litigation, we have also seen numerous states, and even Congress, begin to consider legislation that would address the catastrophic losses suffered by businesses. Some states have proposed laws that would retroactively invalidate viral exclusions that are found in many (but not all) policies. Some have proposed laws that would require the phrase “physical loss or damage” to be construed in a manner that would require coverage. Most have limited their application only to businesses with one hundred or less employees. And the federal government has begun to consider a federally-backed insurance program for future pandemics, similar to flood or terrorism insurance.

Insurers, for their part, have asserted that any attempt to retroactively modify existing policies would result in constitutional challenges and yet more litigation. As of the date of this article, no such legislation has been passed and its future is, again, uncertain.

Other First-Party Coverages

Communicable Disease. Some insureds carry Communicable Disease coverage, usually written as an additional coverage or endorsement on their property policy. This coverage generally applies where there has been an order of a public health authority (or in some policies, direct loss or damage) that requires an insured location to be evacuated, decontaminated, or disinfected due to an outbreak of a disease or virus. It covers both the cost of any decontamination and, often, business interruption losses as well, though usually both coverages are subject to significantly lower sub-limits. While at first blush, Communicable Disease coverage would clearly seem to apply to COVID-19 losses, and some claims have indeed been paid, insurers have been denying other claims where the insured has not demonstrated an actual outbreak at their premises. Insureds contend that the virus was, in fact, everywhere where people congregated—a fact confirmed by state governors when they passed stay-at-home orders, and even by the Pennsylvania Supreme Court in upholding that state’s order.

Event Cancellation. Insureds with Event Cancellation insurance also sought coverage for pandemic-related cancellations of sporting events, concerts, and more. These policies generally cover at least some lost revenues and out-of-pocket expenses, and may include communicable diseases or pandemics as covered causes of loss. However, some insurers have denied claims on the grounds that coverage is not triggered if an organizer cancelled an event merely due to fear of the virus in the community.

Pollution. Pollution policies provide coverage for clean-up costs and, sometimes, business interruption losses when there has been a pollution event. While policy wording varies, a pollution event may include the dispersal or discharge of a virus, rendering an insurer responsible for resulting losses. Even when acknowledging a pollution event, however, some insurers have denied COVID-19-related claims on the basis that the losses were not related to the discharge of pollutants (i.e., the virus), but rather the result of governmental shut-downs that were prophylactic in nature.

Third-Party, Liability Coverages

General Liability. As restrictive governmental orders were lifted, allowing businesses to reopen, many questioned their liability exposure if customers, vendors, or others were to become infected. Early in the pandemic, Princess Cruise Lines was sued for failing to take precautions to prevent an outbreak after two passengers on the previous sailing ship reported symptoms. Generally though, we have not yet seen an avalanche of customer claims. In part, this may be because it would be extraordinarily difficult to prove that someone became infected at a particular location, a necessary element of any negligence case. Further, some states, such as Ohio, have enacted laws to shield organizations from liability except in extreme circumstances.

To the extent such claims are made, however, coverage prospects appear quite good—at least for policies issued before the pandemic that don’t contain a viral or communicable disease exclusion. General liability policies cover an insured’s legal liability for damages arising from bodily injury, so long as it was caused by an accident. While insurers may argue standard-form pollution exclusions preclude coverage for viral injuries, there is little in the policy language or its history of development that would support that argument. That said, insurers are more likely to insist on the inclusion of communicable disease or viral exclusions for policy renewals going forward.

Directors & Officers Insurance. Shareholders may bring lawsuits where the actions or inaction of a company’s directors and officers have caused the company loss—i.e., the failure to develop a contingency plan or the failure to disclose risks posed to financial performance. Several such suits have been filed in the wake of the pandemic. While D&O coverage is incredibly broad for individual insureds—generally covering all allegations of acts, errors, omissions, or misstatements—policies generally include an exclusion for bodily injury. The precise wording of the exclusion varies—while some policies preclude coverage for any claim relating in any way to bodily injury, others do not preclude coverage for the economic damage suffered by others (i.e., shareholders).

Employment Practices Liability Insurance. COVID-19 has created unique workplace challenges for employers. For example, can companies require their employees to travel to affected areas for work? Can companies terminate employees that refuse to come to work or insist on working from home? While EPLI coverage provides protection against employee claims of wrongful termination and similar claims, some coverages are limited. For example, most policies exclude coverage for violations of OSHA or FMLA (except for retaliation). Most exclude, or limit, coverage for wage and hour claims and FLSA violations. Because these types of claims are more likely in the context of the pandemic, insureds should carefully review their policies to identify prospective coverages.

Conclusion

Brouse McDowell will continue to update our clients and friends as these issues develop. You can read all our coronavirus-related updates on our webpage. In the interim, we are assisting our policyholder clients in analyzing their policies and potential claims arising from this pandemic, and we encourage policyholders to carefully review their policies to determine if coverage is available to them.

Share Article Via

“Late” Notice? Remain Calm; All May Be Well.

Everyone has heard a late notice story. There is a loss; and there is insurance that potentially covers that loss. But for reasons that make sense at the time, the policyholder does not immediately provide notice to the insurer. Maybe the policyholder did not know that coverage was available for the loss; maybe the policyholder wanted to get more information about the loss before submitting; or maybe the policyholder’s dog ran away. The possible reasons are endless.

But “late” notice happens. And when it does, insurers are quick to point out that their policy requires the policy-holder to provide “prompt” or “timely” notice. But in Ohio, the validity of the insurers’ late notice defense is subject to a two-part inquiry:

Did the policyholder breach the insurance policy by failing to provide notice “with-in a reasonable time in light of all the surrounding facts and circumstances;” and

If the policyholder did breach the policy’s notice provision, did that breach prejudice the insurer?

See Ferrando v. Auto-Owners Mut. Ins. Co., 98 Ohio St.3d 186 (2002). If the answer to either inquiry is no, then the insurers’ late notice defense fails.

Recently, in LTF 55 Properties, LTD v. Charter Oak Fire Ins. Co., No. CV18905321, 2020-Ohio-4294 (8th Dist. Sept. 3), an insurer asked the Ohio Court of Appeals to turn the long-standing two-part inquiry on its head, seeking a holding that “delays predicated on expediency or self-interest are per se unreasonable.”

LTF owned a commercial property in Cleveland. It rented part of the property to Garda Arch Fab, LLC, with which it had some overlap in management. NEO Contractors also rented portions of the property from LTF, but those en-tities were not related.

Profac, Inc. contracted with LTF and Garda to operate LTF’s property and agreed that, at some point in the future, it would buy out those entities. In connection with its agreement to operate LTF and Garda and the eventual buy-out, Profac insured the property through Charter Oak, listing both LTF and Garda as additional named insureds.

A fire broke out at LTF’s property on October 19, 2016. Ultimately, the origin of the fire was determined to be a NEO-owned truck stored at the property. Following the fire, NEO notified Grange (its insurer) of the potential claim. LTF and Garda sent notice to Profac and inquired about providing notice to Charter Oak. Profac’s president responded by saying that it would handle the claim, that Profac had notified the agent who secured the policy with Charter Oak, and that LTF and Garda were to take no further action regarding the potential insurance claim.

Approximately one month after the fire, LTF and Garda accepted $100,000 from NEO’s insurer Grange and fully released NEO and Grange from any claims regarding the fire. But in January 2017, LTF and Garda determined that the $100,000 was insufficient to repair the fire damage. However, LTF and Garda still did not provide notice to Charter Oak, as by this time the deal with Profac had soured and the parties were negotiating the terms of their “business divorce.”

Finally, in March of 2017, LTF and Garda provided notice of the fire to Charter Oak, along with a proof of loss for over $350,000, the unreimbursed portion of their loss. Charter Oak denied LTF and Garda’s claim, taking the position that the five-month delay in providing notice was unreasonable and had prejudiced its ability to investigate the loss. LTF and Garda filed suit, but the court granted summary judgment in Charter Oak’s favor on the lack of notice issue, finding that the delay was “unreasonable and deliberate” and that the delay had prejudiced the insurer. Garda and LTF appealed.

On appeal, Charter Oak focused on the circumstances surrounding the late notice. Charter Oak took exception to the reason for the five-month delay: LTF and Garda’s commercial interest in not souring their pending deal with Profac. Charter Oak’s position was that because the reason for the delay was commercial self-interest, the delay was per se unreasonable.

But the court took issue with Charter Oak’s attempts to invoke a per se rule regarding delay. First, the court noted that Charter Oak had the burden to demonstrate that there were no issues of material fact regarding the reasona-bleness of the delay. While the court conceded “the circumstances of [LTF and Garda’s] notice appear to be undisputed,” that does not mean that there is no factual dispute regarding the reasonableness of the delay. And here, there were facts that might make the delay reasonable, including LTF’s and Garda’s belief that the $100,000 payment from Grange was sufficient to restore the property, the president of Profac’s statement that Profac would handle the loss, and his statement that he had already reported the fire to the applicable insurance agent.

So, what are the takeaways?

- First and foremost, a policyholder should treat notice like voting in Chicago in the 1960s: give notice early and give notice often.

- Second, if you are going to insure multiple companies with different owners and managers, you should have a clear understanding of all parties’ rights and responsibilities. LTF and Garda could have avoided litigation if Charter Oak was notified when those entities provided notice to Profac. Post-loss responsibilities among the companies insured by Charter Oak could have – and perhaps should have – been set forth in an agreement among them.

- Finally, if the insured says your notice is “late,” it is the beginning of the inquiry, not the end. Whether that notice was late for some benign reason or even if it was late because you were protecting your economic interest, all is not lost. The question is not “why was it late” but instead “no matter why, was it reasonable?”

Share Article Via

Year in Review: 2020 Non-COVID Related Decisions from Across the Country

The pandemic rendered 2020 an unprecedented year for the country. COVID-19 quickly became the dominant focus of our businesses, the news, and our lives. Despite the universal distraction that COVID presented, companies and courts alike found a way to conduct business as usual, resulting in several notable decisions on coverage issues this year that you may have missed amidst the COVID fog.

Montrose v. Superior Court, 260 Cal. Rptr. 3d 822 (2020)

One of the most notable decisions this year came out of the California Supreme Court and addressed the hotly disputed issue of whether a policyholder is entitled to spike a single tower of primary and excess coverage, i.e., “vertical exhaustion,” or whether the policyholder must first exhaust all primary policies before seeking coverage under its excess layers, i.e., “horizontal exhaustion,” when multiple years of coverage are triggered by continuous losses. In Montrose Chemical Corp. of California v. Superior Court of Los Angeles County, the California Supreme Court applied the “vertical exhaustion” rule, reasoning that the burden of spreading multi-year losses should be on the insurers and not the policyholder. Although every coverage case is different based on the facts and terms of the policies, the Montrose decision is considered a win for policyholders who otherwise face effectively forfeiting their coverage due to high retentions or gaps often present at the primary level.

West Bend Mutual Insurance v. Krishna Schaumberg Tan, Inc., 2020 IL App (1st) 191834 (March 20, 2020)

In today’s hyper-connected world, privacy claims continue to dominate the courts. Earlier this year, an Illinois appeals court required West Bend Mutual to defend a class action brought against the insured tanning salon under Illinois’ Biometric Information Privacy Act. The salon’s general liability policy required West Bend to defend it against claims stemming from the publication of material that violated an individual’s privacy rights. The issue in this case was whether the tanning salon’s disclosure of its customers’ fingerprints to a single third-party vendor met the publication requirement of the policy. West Bend argued that the term required disclosure of information to the public at large, but the trial court and appellate court both disagreed, ruling that a publication can be found where data is shared only with one person, giving rise to a potential of coverage under the policy and requiring West Bend to defend. The West Bend case constitutes another victory for policyholders amidst the conflicting decisions across the country on what constitutes publication.

Charter Oak Fire Ins. Co. v. Zurich American Ins. Co., No. 19-cv-4212, 2020 WL 1989399 (S.D.N.Y. April 27, 2020)

A recent decision out of a New York federal court is among the first to interpret a 2013 addition to ISO’s additional insured endorsement which provides that the coverage afforded to the additional insured “will not be broader” than that which the contractor was required to provide by contract. In this case, Charter Oak issued a CGL policy to a building owner, which also was insured under an additional insured endorsement issued to an elevator contractor. Charter Oak argued that Zurich was primarily responsible to defend the lawsuit, but Zurich relied on the “will not be broader” language in the endorsement to argue otherwise. The New York court ruled that the phrase refers to the contract between the building owner and contractor, which required the contractor to extend coverage to the building owner for any claims caused “in whole or in part” by the contractor’s negligence. Because such negligence was alleged in the underlying case, Zurich was required to defend. The decision serves as another reminder to construction policyholders to carefully draft and review their contracts as they relate to additional insured coverage.

G&G Oil Co. of Indiana v. Continental Western Ins. Co., 145 N.E.2d 842 (Ind. Ct. App. 2020)

A ruling this year from the Indiana Court of Appeals concerned an issue of national first impression among appellate courts in the area of cybercrime. In this case, the policyholder was a victim of a ransomware attack leaving its computer servers inaccessible. The policyholder paid four bitcoins ($35,000) in exchange for decryption passwords to regain access. The policyholder subsequently asserted coverage for the payment under the computer fraud section of its crime policy, but the insurer denied coverage. The lower and appellate Indiana courts ruled in favor of the insurer, finding that the bitcoin payments were not the result of fraudulent use of a computer. Rather, the court characterized the crime as theft, as there was no deception involved. Cybercrime policies have been prevalent in the industry for some time, and are widely noted as being written very specifically as to what they cover. Whenever policyholders are purchasing cyber insurance or submitting cyber claims, they are prudent to carefully analyze the coverage provisions and claim facts utilizing team members from their risk, legal, and IT departments, along with an experienced broker, to ensure all risks are addressed and all potentially applicable policies are notified.

Loya Insurance v. Avalos, 63 Tex. Sup. Ct. J. 969 (2020)

In the last of the cases highlighted in this article, the Texas Supreme Court adopted a collusive fraud exception to the state’s eight-corners rule for determining the duty to defend. The eight-corners rule provides that when determining the duty to defend, the court must only consider the four-corners of the policy and the four-corners of the complaint. In fact, within less than two months, the Texas Supreme Court again reaffirmed the eight-corners rule, rejecting an insurer’s attempt to limit the rule to where the insurer agreed to defend “no matter if the allegations of the suit are groundless, false or fraudulent.” State Farm Lloyds v. Richards, Texas Supreme Court Case No. 19-0802. In Avalos, however, the Texas Supreme Court allowed Loya Insurance to introduce outside evidence to prove that one of its policyholders committed fraud to secure coverage of an underlying personal injury suit. The high court found that the insurer had no duty to defend, adopting a “collusive fraud” exception to the eight-corners rule, although it stressed that the exception was narrow, and unless insurers have convincing evidence of fraud discovered early on, they should err on the side of caution and defend.

Share Article Via

A Fixed Attachment Point: Excess Insurer to Pay Long-Tail Claims Exceeding Policy Limits

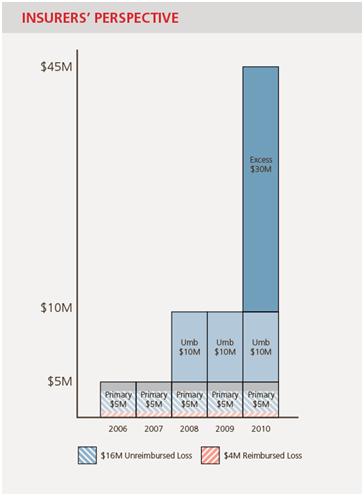

In William Powell Co. v. OneBeacon Ins. Co., 1st Dist. Hamilton No. C-190199, 2020-Ohio-5325, Ohio’s First District Court of Appeals held that an excess insurer’s attachment point holds constant, in accordance with the terms of the policy, regardless of whether a policyholder purchases additional primary policies covering a long-tail claim. The court framed the issue as whether a policyholder is required to exhaust its insurance coverage vertically or horizontally.

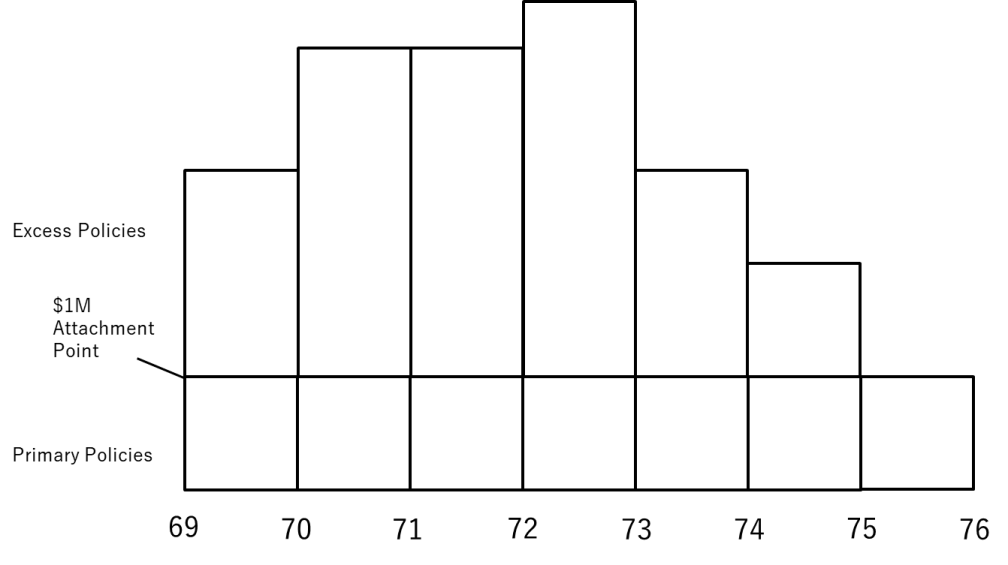

This framing is impossible to appreciate without first picturing a coverage chart—which is a graph that looks like a series of blocks stacked along an x and y axis. Each block is an insurance policy. The width of the block, running along the x-axis, represents the time the policy was in place; the length of the block, stretching up the y-axis, represents the coverage limits of each policy. The first layer of blocks represents the policyholder’s primary insurance policies. The blocks stacked on top of the primary layer are umbrella and excess policies.

Figure 1. Coverage Chart

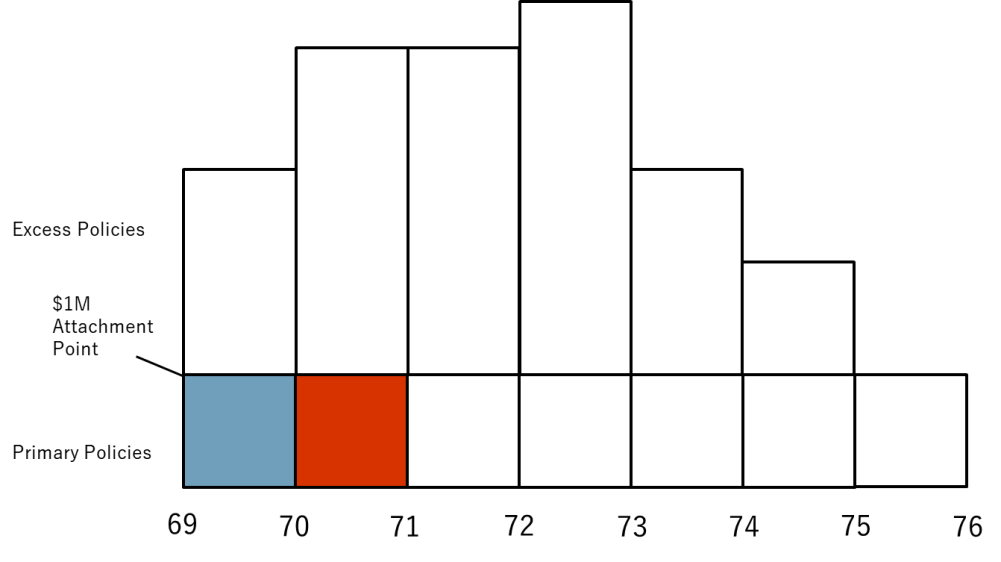

Pointing to this picture in Figure 1, excess insurers will sometimes argue that, before a policyholder can recover against the excess policy, it has to collect from all the primary policies that provide coverage. This is called horizontal exhaustion.

Figure 2. Horizontal Exhaustion

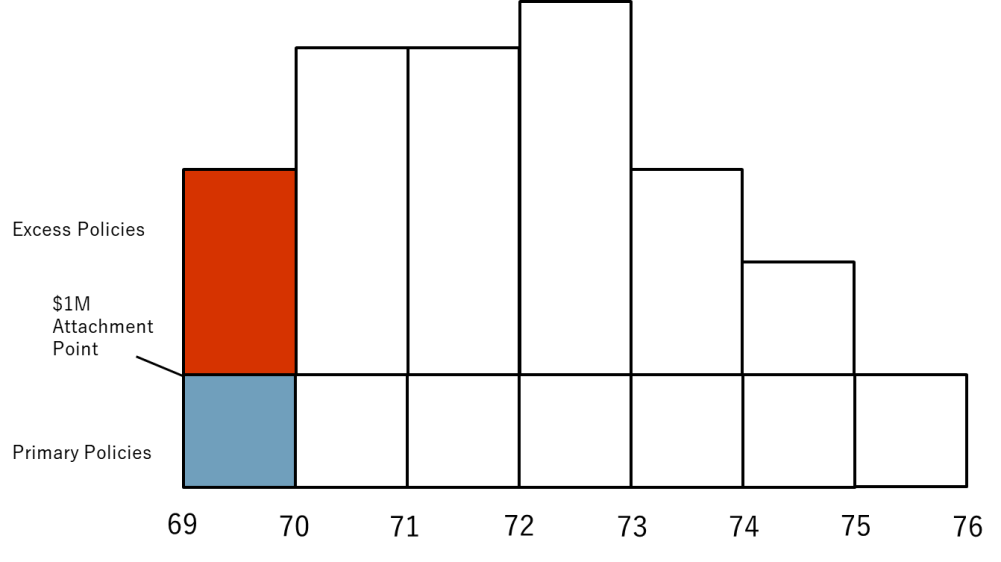

Policyholders push back, arguing that they only have to collect from the policies directly underneath the excess policy. This is called vertical exhaustion.

Figure 3. Vertical Exhaustion

Ultimately, though, vertical exhaustion and horizontal exhaustion are dueling approaches to interpreting a coverage chart, not an insurance policy. No excess policy mentions exhaustion—vertical, horizontal, or otherwise. Instead, excess policies normally say something to the effect that they will pay losses that exceed the limits of “underlying insurance.” The total underlying limits of an excess policy is referred to as that policy’s “attachment point”—i.e., the point at which the excess policy begins paying.

Returning to the coverage chart, the attachment point is the line where the excess policy rests on top of an underlying insurance policy. Horizontal exhaustion, in effect, is an attempt to raise this line.

Take as an example an excess policy with an attachment point of $1 million. In the normal course, that excess policy will pay the next dollar of liability over $1 million, plus every dollar after that, up to the excess policy’s limit. But, if the policyholder is required to horizontally exhaust its coverage, then the next dollar of liability is not paid by the excess policy. It is paid, instead, by the next primary policy. So, in essence, the attachment point of the excess policy is no longer $1 million. It is $1 million plus the combined limits of every underlying policy that might be triggered by a long-tail claim.

There is nothing in the language of most excess policies, however, that would permit an insurer to raise its attachment point. The court in William Powell correctly held that excess insurers are required to pay losses that exceed the limits of underlying policies covering the same policy periods as the excess policy. This holding is helpful to policyholders, who can rely on it to press excess insurers to pay more quickly for long-tail claims spanning multiple policy periods.

Share Article Via

Contaminants of Emerging Concern and Insurance Coverage

There is general familiarity with some chemicals and the risks these chemicals pose to human health and the environment. If trichloroethylene (TCE) is present in soil or groundwater at a former industrial site, the potential risks of exposure and associated liabilities are commonly understood.

TCE, along with vinyl chloride and dioxin, are just three examples of common chemicals regulated under federal and state environmental laws. But, have you ever heard of PFAS (per- and polyfluoroalky substances) or 1, 4 dioxane? PFAS and 1, 4 dioxane are examples of contaminants of emerging concern, or “emerging contaminants.” While neither of these two chemicals are “new,” they are part of a class of chemicals that had historically been unregulated, and not classified as “hazardous” under federal or state laws. However, as knowledge of the health risks associated with contaminants of emerging concern develops, so has federal and state regulation. With the increase in regulation, policyholders and their advisors should understand what contaminants of emerging concern are and be aware of the types of insurance coverage that might be available for the costs of investigating or remediating an environmental impact caused by these contaminants and to cover potential third-party claims.

What are emerging contaminants?

Contaminants of emerging concern form a broad category of chemicals or materials that are characterized by a perceived, potential, or real threat to human health or the environment, or by a lack of published health standards. These chemicals or materials are generally widespread, persistent in the environment, and generally not regulated. Many chemicals and materials considered to be a contaminant of emerging concern have been in use for decades, yet the health risks of such chemicals or materials are only now becoming known.

The group of contaminants of emerging concern currently receiving the most attention are PFAS, a family of nearly 5,000 man-made chemicals. PFAS have been extensively manufactured and used worldwide since the 1950s. These chemicals have unique physical and chemical properties that include repelling water, acting as a surfactant, and repelling oil. PFAS have been used in food packaging, household products such as water and stain repellent fabrics, non-stick products, waxes, paints, and even certain firefighting foams. There has been an increase in regulations of PFAS, particularly related to drinking water standards.

Another contaminant of emerging concern that is seeing increased regulation is 1,4-dioxane, a synthetic industrial chemical used as a stabilizer in certain chlorinated solvents. The chemical 1,4-dioxane is likely found at many sites contaminated with certain chlorinated substances because of its widespread use as a stabilizer for solvents. According to the U.S. EPA, as of 2016 1,4-dioxane has been identified at more than thirty-four National Priority List (NPL) sites and presumed to be present, but not tested for, at additional sites.

Pesticides (such as Glyphosate), pharmaceuticals, nanomaterials, perchlorate, and brominated flame retardants (BFRs) are also contaminants of emerging concern. All these contaminants of emerging concern pose a risk to human health and the environment. Although there is little regulation of these contaminants, the federal government is beginning to implement guidance and regulations that require monitoring and remediation of some of them under existing regulations such as Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), The Resource Conservation and Recovery Act (RCRA), and the Safe Drinking Water Act. Many states are moving to regulate PFAS substances as well. Both Michigan and New Jersey have enacted rules creating some of the nation’s most comprehensive and strictest regulations setting standards for PFAS in drinking water. Ohio has developed an action plan to address this as well, however, without enacting any standards of its own. As this shows, regulation is not widespread on a national scale, so there are different requirements depending on location.

Policyholder considerations

Environmental liabilities related to contamination caused by a contaminant of emerging concern may arise under various circumstances. A policyholder could place itself in the chain of title by acquiring property that might have the potential for soil or groundwater contamination and become a potentially responsible party for the environmental impacts at the site. A policyholder could face liabilities for environmental conditions related to its use or disposal of products that may contain or be a contaminant of emerging concern. The bulk of enforcement, whether it be third-party litigation or government investigations, has been directed at product manufacturers. Since there was no regulation of contaminants of emerging concern historically, when manufacturers used them, they were typically not treated prior to being discharged into a water body, often emitted directly into the air, or disposed of at a landfill not adequate to protect against the release, creating a long list of potential environmental liabilities.

Regardless of the particular circumstance of the policyholder, careful scrutiny is required to determine whether there is insurance coverage available.

Types of coverage that might be available

Potential coverage for environmental impacts related to contaminants of emerging concern could exist under comprehensive general liability policies or pollution legal liability (PLL)insurance. The type of insurance needed to cover liabilities related to contaminants of emerging concern will differ depending on the situation. If an insurer is currently manufacturing or selling products that contain such a contaminant, a thorough evaluation of available policies and potential risk exposures will need to be done to ensure risks of liability from a government-ordered investigation or third-party claim are covered. The policyholder should understand what the contaminant of emerging concern at the property is and the timeframe in which the damage to the property occurred. Once there is an understanding of the potential exposure risks, the next step is to assess the types of insurance coverage available. Performing a historical analysis of the policies available will allow the policyholder to determine whether there could be coverage under a CGL policy that does not contain a pollution exclusion (pre-1985 policy). This type of analysis will also assist in determining if PLL insurance should be considered. A PLL policy could offer more comprehensive coverage, especially since the risks associated with contaminants of emerging concern are still developing and there is limited regulation, therefore, there is less of a chance of a specific exclusion being included in the policy. A PLL policy can manage pollution liability risks associated with on- and off-site remediation expenses and third-party liabilities, as well as known pollution conditions in contaminated property transfers.

Takeaways:

- Know which contaminants of emerging concern might affect you;

- Evaluate both current and historic coverage available; and

- Consider adding a pollution legal liability policy to cover certain risks, especially for property transfers.

Share Article Via

Ohio Court Recognizes Coverage for Opioid Claims

Widespread addiction to opioid medications has led to a national health crisis. Governmental entities, such as states, cities, and counties, have incurred enormous costs in dealing with this crisis, including costs for medical response, intervention, and treatment. These governmental entities have asserted claims for these costs against companies in the stream of commerce for these medications, including manufacturers, wholesalers, distributors, and pharmacies. Huge settlements and verdicts have resulted from governmental lawsuits over these claims, some in the hundreds of millions or billions of dollars.

The companies sued in these cases have looked to their general liability insurers for defense and indemnity. Insurers, however, much as they did in response to earlier waves of expensive liability claims—such as asbestos or environmental claims—typically have denied the claims, at times without any apparent regard for the claim merits. Coverage litigation has ensued nationally. Courts are beginning to weigh in on the coverage issues, although there have been very few decisions to date from appellate courts.