Insights

Labor & Employment Alert: Latest Government Guidance on Requesting Employee Documentation to Approve Leaves Under New Federal Programs

By Stephen P. Bond & Christopher J. Carney on April 3, 2020

No doubt, all employers with 500 or fewer employees are now aware of the federal mandates to provide both paid sick leave and expanded FMLA leave to their employees who qualify. The situation has been a bit hazy, however, with respect to exactly when these benefits commence, and what information an employer could/should compile from the employee in order to receive these benefits. The federal law is ambiguous; two agencies, the Department of Labor and IRS have input into the enforcement mechanisms and their “guidance” has been confusing. But, with publications issued earlier this week, the fog has cleared; and we can now offer these clarifications:

1) The triggering date is April 1, 2020i. Leave/absences which have occurred prior to that time will not count against the benefits to which employees may be entitled under the new law;ii nor will tax credits be applicable to compensation issued to employees prior to April 1, 2020.iii

2) Employers do have the right to request documentation from the employee, demonstrating that they fit the criteria for the new law to apply; employers may insist on the documentation as a condition for awarding the payiv; and employers will be required to maintain that documentation to justify any applications for tax credits.

3) The specific documentation that is to be requested is as followsv:

a. Employee’s name;

b. Date(s) for which leave is requested;

c. Qualifying reason for the leave; and

d. Oral or written statement that the employee is unable to work because of the qualified reason for leave.

Plus,

(i) If the reason is due to a government order, the name of the entity that issued the order;

(ii) If the reason is due to being told to self-quarantine, the name of the health care provider who advised the employee to self-quarantine due to concerns related to COVID-19

(iii) If the reason is to care for a child because the child’s school or caregiver have closed or become unavailable due to COVID-19,

A. the name and age of the child being cared for,

B. the name of the school or child care provider that is unavailable, and

C. a representation that no other suitable person will be caring for vi the son or daughter during the period for which the employee takes Federal Paid Sick Leave or Expanded Family and Medical Leave,

D. (and, with respect to the employee’s inability to work or telework because of a need to provide care for a child older than fourteen during daylight hours, a statement that special circumstances exist requiring the employee to provide care).

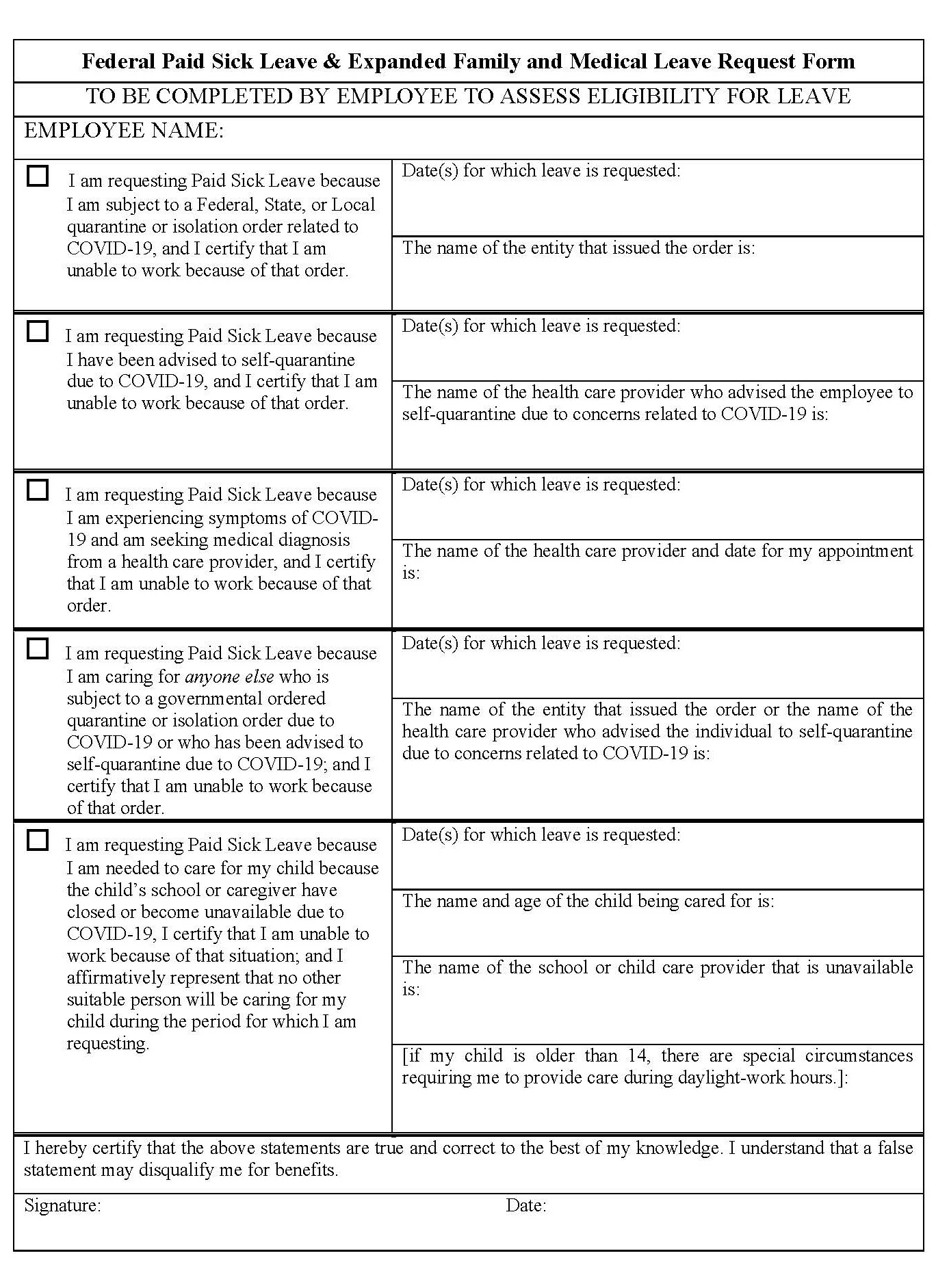

What follows is a proposed format that could be used for employee leave requests under this new government guidance.

i

1. What is the effective date of the Families First Coronavirus Response Act (FFCRA), which includes the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act?

The FFCRA’s paid leave provisions are effective on April 1, 2020, and apply to leave taken between April 1, 2020, and December 31, 2020.

Wage and Hour Division, “Families First Coronavirus Response Act: Questions and Answers,” No. 1 (3/28/2020).

ii

11. Can my employer deny me paid sick leave if my employer gave me paid leave for a reason identified in the Emergency Paid Sick Leave Act prior to the Act going into effect?

No. The Emergency Paid Sick Leave Act imposes a new leave requirement on employers that is effective beginning on April 1, 2020.

Wage and Hour Division, “Families First Coronavirus Response Act: Questions and Answers,” No. 11.

13. Are the paid sick leave and expanded family and medical leave requirements retroactive?

No.

Wage and Hour Division, “Families First Coronavirus Response Act: Questions and Answers,” No. 13.

iii

III. IMPLEMENTATION OF SECTIONS

With respect to the period "beginning on a date selected by the Secretary (or the Secretary’s delegate) which is during the 15-day period beginning on the date of the enactment of this Act” as specified in sections 7001(g), 7002(e), 7003(g), and 7004(e) of Division G of the Act, the date selected by the Secretary is April 1, 2020. This date is coordinated with the DOL’s determination of the effective date for employers’ compliance with the Emergency Family and Medical Leave Expansion Act and Emergency Paid Sick Leave Act requirements. Accordingly, the refundable tax credits for employers apply to qualified sick leave wages and qualified family leave wages paid for the period from April 1, 2020 to December 31, 2020.

IRS Notice 2020-21, “Effective Date for Employment Tax Credits Under the Families First Coronavirus Response Act” (3/27/2020).

iv

15. What records do I need to keep when my employee takes paid sick leave or expanded family and medical leave?

Private sector employers that provide paid sick leave and expanded family and medical leave required by the FFCRA are eligible for reimbursement of the costs of that leave through refundable tax credits. If you intend to claim a tax credit under the FFCRA for your payment of the sick leave or expanded family and medical leave wages, you should retain appropriate documentation in your records. You should consult Internal Revenue Service (IRS) applicable forms, instructions, and information for the procedures that must be followed to claim a tax credit, including any needed substantiation to be retained to support the credit. You are not required to provide leave if materials sufficient to support the applicable tax credit have not been provided.

If one of your employees takes expanded family and medical leave to care for his or her child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19, you may also require your employee to provide you with any additional documentation in support of such leave, to the extent permitted under the certification rules for conventional FMLA leave requests. For example, this could include a notice that has been posted on a government, school, or day care website, or published in a newspaper, or an email from an employee or official of the school, place of care, or child care provider.

16. What documents do I need to give my employer to get paid sick leave or expanded family and medical leave?

You must provide to your employer documentation in support of your paid sick leave as specified in applicable IRS forms, instructions, and information.

Your employer may also require you to provide additional in support of your expanded family and medical leave taken to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19-related reasons. For example, this may include a notice of closure or unavailability from your child’s school, place of care, or child care provider, including a notice that may have been posted on a government, school, or day care website, published in a newspaper, or emailed to you from an employee or official of the school, place of care, or child care provider. Your employer must retain this notice or documentation in support of expanded family and medical leave, including while you may be taking unpaid leave that runs concurrently with paid sick leave if taken for the same reason.

Please also note that all existing certification requirements under the FMLA remain in effect if you are taking leave for one of the existing qualifying reasons under the FMLA. For example, if you are taking leave beyond the two weeks of emergency paid sick leave because your medical condition for COVID-19-related reasons rises to the level of a serious health condition, you must continue to provide medical certifications under the FMLA if required by your employer.

Wage and Hour Division, “Families First Coronavirus Response Act: Questions and Answers,” Nos. 15-16.

v

29 CFR § 826.100; IRS Guidance, “COVID-19-Related Tax Credits for Required Paid Leave Provided by Small and Midsize Businesses FAQs,” No.44 (4/1/2020).

vi

29 CFR § 826.20 Paid Leave Entitlements.

(a) Qualifying reasons for Paid Sick Leave.

***

(6) Caring for a Son or Daughter. An Employee has a need to take Paid Sick Leave if he or she is unable to work due to a need to care for his or her Son or Daughter whose School or Place of Care has been closed, or whose Child Care Provider is unavailable, for reasons related to COVID-19 only if no other suitable person is available to care for the Son or Daughter during the period of such leave.

***

(b) Qualifying reason for Expanded Family and Medical Leave. An Eligible Employee may take Expanded Family and Medical Leave because he or she is unable to work due to a need to care for his or her Son or Daughter whose School or Place of Care has been closed, or whose Child Care Provider is unavailable, for reasons related to COVID-19. Eligible Employee has need to take Expanded Family and Medical Leave for this purpose only if no suitable person is available to care for his or her Son or Daughter during the period of such leave.