Insurance Recovery Newsletter Vol. XXV 2020

Table Of Contents

- Your 2020 Newsletter from Brouse McDowell

- Insurance Coverage for Losses and Claims Arising From COVID-19

- “Late” Notice? Remain Calm; All May Be Well.

- Year in Review: 2020 Non-COVID Related Decisions from Across the Country

- A Fixed Attachment Point: Excess Insurer to Pay Long-Tail Claims Exceeding Policy Limits

- Contaminants of Emerging Concern and Insurance Coverage

- Ohio Court Recognizes Coverage for Opioid Claims

- Ohio Supreme Court Preserves Policyholder Allocation Rights

- Ohio Court Rules in Policyholder’s Favor on Scope of Pollution Exclusion & Settlement Credits

- What to Expect When You Are Renewing

- Attorney Highlights

Your 2020 Newsletter from Brouse McDowell

Amanda M. Leffler, Lucas M. Blower

It goes without saying that 2020 has been filled with substantial change, rampant uncertainty, and unexpected challenges for nearly every one of our clients and friends. Like all of you, our firm has seen first-hand the wide-ranging effects of the COVID-19 pandemic on businesses. Together with the movement to fight social injustice and the impact of the presidential election, 2020 will unquestionably have a lasting and historic effect on our economy, in both the short and long-term.

The insurance market, likewise, has not been immune to the “new normal.” Insurers and policyholders affected by the pandemic have been litigating throughout the year over whether there is insurance coverage when an entire economy shuts down. Amanda M. Leffler, in her article Insurance Coverage for Losses and Claims Arising from COVID-19, discusses these cases and the prospect for policyholders recovering under their property, liability, and other policies.

We expect that many of these issues will be resolved in 2021 at the earliest. This uncertainty is just one of the factors contributing to a hardening insurance market. In her article What to Expect When you are Renewing, Stacy RC Berliner addresses these changes in the market and shares practical tips for your next renewal.

Meagan L. Moore, in her article Contaminants of Emerging Concern and Insurance Coverage, addresses an issue that will become potentially more prominent in a Democratic administration. She discusses coverage for environmental liabilities arising out of historically unregulated constituents not previously classified as hazardous under federal or state laws.

Of course, even in times of change, some things are constant. And, in 2020, like in other years, insurance claims, particularly large insurance claims, were denied with some frequency without evident or appropriate regard by insurers for their merit. In articles written by Andrew W. Miller, P. Wesley Lambert, Jodi Spencer Johnson, Lucas M. Blower, and Paul A. Rose, we discuss significant decisions rendered by courts—both in Ohio and nationally—where policyholders have prevailed against insurers that have wrongfully denied valid claims.

As we look forward to the next year, we expect that many of these issues will continue to arise in disputes between insurers and their policyholders. The attorneys at Brouse McDowell, as always, are committed to both informing and protecting policyholders in Ohio and throughout the nation.

It is our sincere hope that you find this newsletter useful.

Share Article Via

Insurance Coverage for Losses and Claims Arising From COVID-19

COVID-19 has impacted nearly every aspect of our lives, resulting in catastrophic losses and prospective liability for businesses of every size across the globe. Over the past nine months, our firm has counseled clients, brokers, and friends, helping them navigate the complex world of insurance to answer the question keeping them up at night: is my business going to be covered for all of this?

As with nearly any insurance claim, the answer to that simple question depends on the specific language of your insurance policy and the unique facts applicable to your claim. Some trends have developed since the pandemic began, however, and new issues continue to emerge as employees head back to the office and stakeholders consider ways to recoup their own losses. These trends and issues are discussed below.

Business Interruption Insurance

By this point, nearly everyone has heard of business interruption insurance—the first-party coverage that is provided with some, but not all, property policies. This insurance is designed to indemnify the insured for lost profits when its business is unable to operate as a result of an unforeseen event. When the pandemic forced countless businesses to close their doors or severely restrict their operations, numerous insureds turned to their insurers for relief. In virtually every case, though, the insurers denied these claims.

Insurers identified several bases for their denials: (1) that the policy only covers damage to, or destruction of property, which doesn’t exist in the context of coronavirus claims; (2) that, even if property damage exists, it didn’t cause the insured’s loss of income (i.e., the insured didn’t close because of property damage, but to limit the spread of the virus); and (3) that viral/bacterial exclusions preclude coverage in any event. In response, thousands of insureds in nearly every state filed lawsuits against the insurers. The insureds noted that there are multiple cases which have found coverage under similar circumstances, i.e., cases where courts have held that property can sustain “physical damage” even if it hasn’t suffered “structural alteration.”

Only a handful of these cases have been decided. While most cases remain pending, several trial courts have dismissed claims, generally on the grounds that the insured failed to plead that it suffered any “direct loss or damage” to the insured premises. These dismissals have made one thing clear—hiring experienced insurance counsel is critical. Many sophisticated insurance commentators agree that at least some of these cases would not have been dismissed if they had been pled to more clearly fall within the coverage of the policy. Of course, these cases are subject to appeal and, more recently, we’ve seen a handful of trial courts affirmatively deny insurers’ attempts to avoid their coverage obligations for business income losses. Simply put, we are quite early in the development of the case law on coverage for COVID-19 losses, and whether there will generally be coverage for these losses remains undecided in every jurisdiction.

In addition to the litigation, we have also seen numerous states, and even Congress, begin to consider legislation that would address the catastrophic losses suffered by businesses. Some states have proposed laws that would retroactively invalidate viral exclusions that are found in many (but not all) policies. Some have proposed laws that would require the phrase “physical loss or damage” to be construed in a manner that would require coverage. Most have limited their application only to businesses with one hundred or less employees. And the federal government has begun to consider a federally-backed insurance program for future pandemics, similar to flood or terrorism insurance.

Insurers, for their part, have asserted that any attempt to retroactively modify existing policies would result in constitutional challenges and yet more litigation. As of the date of this article, no such legislation has been passed and its future is, again, uncertain.

Other First-Party Coverages

Communicable Disease. Some insureds carry Communicable Disease coverage, usually written as an additional coverage or endorsement on their property policy. This coverage generally applies where there has been an order of a public health authority (or in some policies, direct loss or damage) that requires an insured location to be evacuated, decontaminated, or disinfected due to an outbreak of a disease or virus. It covers both the cost of any decontamination and, often, business interruption losses as well, though usually both coverages are subject to significantly lower sub-limits. While at first blush, Communicable Disease coverage would clearly seem to apply to COVID-19 losses, and some claims have indeed been paid, insurers have been denying other claims where the insured has not demonstrated an actual outbreak at their premises. Insureds contend that the virus was, in fact, everywhere where people congregated—a fact confirmed by state governors when they passed stay-at-home orders, and even by the Pennsylvania Supreme Court in upholding that state’s order.

Event Cancellation. Insureds with Event Cancellation insurance also sought coverage for pandemic-related cancellations of sporting events, concerts, and more. These policies generally cover at least some lost revenues and out-of-pocket expenses, and may include communicable diseases or pandemics as covered causes of loss. However, some insurers have denied claims on the grounds that coverage is not triggered if an organizer cancelled an event merely due to fear of the virus in the community.

Pollution. Pollution policies provide coverage for clean-up costs and, sometimes, business interruption losses when there has been a pollution event. While policy wording varies, a pollution event may include the dispersal or discharge of a virus, rendering an insurer responsible for resulting losses. Even when acknowledging a pollution event, however, some insurers have denied COVID-19-related claims on the basis that the losses were not related to the discharge of pollutants (i.e., the virus), but rather the result of governmental shut-downs that were prophylactic in nature.

Third-Party, Liability Coverages

General Liability. As restrictive governmental orders were lifted, allowing businesses to reopen, many questioned their liability exposure if customers, vendors, or others were to become infected. Early in the pandemic, Princess Cruise Lines was sued for failing to take precautions to prevent an outbreak after two passengers on the previous sailing ship reported symptoms. Generally though, we have not yet seen an avalanche of customer claims. In part, this may be because it would be extraordinarily difficult to prove that someone became infected at a particular location, a necessary element of any negligence case. Further, some states, such as Ohio, have enacted laws to shield organizations from liability except in extreme circumstances.

To the extent such claims are made, however, coverage prospects appear quite good—at least for policies issued before the pandemic that don’t contain a viral or communicable disease exclusion. General liability policies cover an insured’s legal liability for damages arising from bodily injury, so long as it was caused by an accident. While insurers may argue standard-form pollution exclusions preclude coverage for viral injuries, there is little in the policy language or its history of development that would support that argument. That said, insurers are more likely to insist on the inclusion of communicable disease or viral exclusions for policy renewals going forward.

Directors & Officers Insurance. Shareholders may bring lawsuits where the actions or inaction of a company’s directors and officers have caused the company loss—i.e., the failure to develop a contingency plan or the failure to disclose risks posed to financial performance. Several such suits have been filed in the wake of the pandemic. While D&O coverage is incredibly broad for individual insureds—generally covering all allegations of acts, errors, omissions, or misstatements—policies generally include an exclusion for bodily injury. The precise wording of the exclusion varies—while some policies preclude coverage for any claim relating in any way to bodily injury, others do not preclude coverage for the economic damage suffered by others (i.e., shareholders).

Employment Practices Liability Insurance. COVID-19 has created unique workplace challenges for employers. For example, can companies require their employees to travel to affected areas for work? Can companies terminate employees that refuse to come to work or insist on working from home? While EPLI coverage provides protection against employee claims of wrongful termination and similar claims, some coverages are limited. For example, most policies exclude coverage for violations of OSHA or FMLA (except for retaliation). Most exclude, or limit, coverage for wage and hour claims and FLSA violations. Because these types of claims are more likely in the context of the pandemic, insureds should carefully review their policies to identify prospective coverages.

Conclusion

Brouse McDowell will continue to update our clients and friends as these issues develop. You can read all our coronavirus-related updates on our webpage. In the interim, we are assisting our policyholder clients in analyzing their policies and potential claims arising from this pandemic, and we encourage policyholders to carefully review their policies to determine if coverage is available to them.

Share Article Via

“Late” Notice? Remain Calm; All May Be Well.

Everyone has heard a late notice story. There is a loss; and there is insurance that potentially covers that loss. But for reasons that make sense at the time, the policyholder does not immediately provide notice to the insurer. Maybe the policyholder did not know that coverage was available for the loss; maybe the policyholder wanted to get more information about the loss before submitting; or maybe the policyholder’s dog ran away. The possible reasons are endless.

But “late” notice happens. And when it does, insurers are quick to point out that their policy requires the policy-holder to provide “prompt” or “timely” notice. But in Ohio, the validity of the insurers’ late notice defense is subject to a two-part inquiry:

Did the policyholder breach the insurance policy by failing to provide notice “with-in a reasonable time in light of all the surrounding facts and circumstances;” and

If the policyholder did breach the policy’s notice provision, did that breach prejudice the insurer?

See Ferrando v. Auto-Owners Mut. Ins. Co., 98 Ohio St.3d 186 (2002). If the answer to either inquiry is no, then the insurers’ late notice defense fails.

Recently, in LTF 55 Properties, LTD v. Charter Oak Fire Ins. Co., No. CV18905321, 2020-Ohio-4294 (8th Dist. Sept. 3), an insurer asked the Ohio Court of Appeals to turn the long-standing two-part inquiry on its head, seeking a holding that “delays predicated on expediency or self-interest are per se unreasonable.”

LTF owned a commercial property in Cleveland. It rented part of the property to Garda Arch Fab, LLC, with which it had some overlap in management. NEO Contractors also rented portions of the property from LTF, but those en-tities were not related.

Profac, Inc. contracted with LTF and Garda to operate LTF’s property and agreed that, at some point in the future, it would buy out those entities. In connection with its agreement to operate LTF and Garda and the eventual buy-out, Profac insured the property through Charter Oak, listing both LTF and Garda as additional named insureds.

A fire broke out at LTF’s property on October 19, 2016. Ultimately, the origin of the fire was determined to be a NEO-owned truck stored at the property. Following the fire, NEO notified Grange (its insurer) of the potential claim. LTF and Garda sent notice to Profac and inquired about providing notice to Charter Oak. Profac’s president responded by saying that it would handle the claim, that Profac had notified the agent who secured the policy with Charter Oak, and that LTF and Garda were to take no further action regarding the potential insurance claim.

Approximately one month after the fire, LTF and Garda accepted $100,000 from NEO’s insurer Grange and fully released NEO and Grange from any claims regarding the fire. But in January 2017, LTF and Garda determined that the $100,000 was insufficient to repair the fire damage. However, LTF and Garda still did not provide notice to Charter Oak, as by this time the deal with Profac had soured and the parties were negotiating the terms of their “business divorce.”

Finally, in March of 2017, LTF and Garda provided notice of the fire to Charter Oak, along with a proof of loss for over $350,000, the unreimbursed portion of their loss. Charter Oak denied LTF and Garda’s claim, taking the position that the five-month delay in providing notice was unreasonable and had prejudiced its ability to investigate the loss. LTF and Garda filed suit, but the court granted summary judgment in Charter Oak’s favor on the lack of notice issue, finding that the delay was “unreasonable and deliberate” and that the delay had prejudiced the insurer. Garda and LTF appealed.

On appeal, Charter Oak focused on the circumstances surrounding the late notice. Charter Oak took exception to the reason for the five-month delay: LTF and Garda’s commercial interest in not souring their pending deal with Profac. Charter Oak’s position was that because the reason for the delay was commercial self-interest, the delay was per se unreasonable.

But the court took issue with Charter Oak’s attempts to invoke a per se rule regarding delay. First, the court noted that Charter Oak had the burden to demonstrate that there were no issues of material fact regarding the reasona-bleness of the delay. While the court conceded “the circumstances of [LTF and Garda’s] notice appear to be undisputed,” that does not mean that there is no factual dispute regarding the reasonableness of the delay. And here, there were facts that might make the delay reasonable, including LTF’s and Garda’s belief that the $100,000 payment from Grange was sufficient to restore the property, the president of Profac’s statement that Profac would handle the loss, and his statement that he had already reported the fire to the applicable insurance agent.

So, what are the takeaways?

- First and foremost, a policyholder should treat notice like voting in Chicago in the 1960s: give notice early and give notice often.

- Second, if you are going to insure multiple companies with different owners and managers, you should have a clear understanding of all parties’ rights and responsibilities. LTF and Garda could have avoided litigation if Charter Oak was notified when those entities provided notice to Profac. Post-loss responsibilities among the companies insured by Charter Oak could have – and perhaps should have – been set forth in an agreement among them.

- Finally, if the insured says your notice is “late,” it is the beginning of the inquiry, not the end. Whether that notice was late for some benign reason or even if it was late because you were protecting your economic interest, all is not lost. The question is not “why was it late” but instead “no matter why, was it reasonable?”

Share Article Via

Year in Review: 2020 Non-COVID Related Decisions from Across the Country

The pandemic rendered 2020 an unprecedented year for the country. COVID-19 quickly became the dominant focus of our businesses, the news, and our lives. Despite the universal distraction that COVID presented, companies and courts alike found a way to conduct business as usual, resulting in several notable decisions on coverage issues this year that you may have missed amidst the COVID fog.

Montrose v. Superior Court, 260 Cal. Rptr. 3d 822 (2020)

One of the most notable decisions this year came out of the California Supreme Court and addressed the hotly disputed issue of whether a policyholder is entitled to spike a single tower of primary and excess coverage, i.e., “vertical exhaustion,” or whether the policyholder must first exhaust all primary policies before seeking coverage under its excess layers, i.e., “horizontal exhaustion,” when multiple years of coverage are triggered by continuous losses. In Montrose Chemical Corp. of California v. Superior Court of Los Angeles County, the California Supreme Court applied the “vertical exhaustion” rule, reasoning that the burden of spreading multi-year losses should be on the insurers and not the policyholder. Although every coverage case is different based on the facts and terms of the policies, the Montrose decision is considered a win for policyholders who otherwise face effectively forfeiting their coverage due to high retentions or gaps often present at the primary level.

West Bend Mutual Insurance v. Krishna Schaumberg Tan, Inc., 2020 IL App (1st) 191834 (March 20, 2020)

In today’s hyper-connected world, privacy claims continue to dominate the courts. Earlier this year, an Illinois appeals court required West Bend Mutual to defend a class action brought against the insured tanning salon under Illinois’ Biometric Information Privacy Act. The salon’s general liability policy required West Bend to defend it against claims stemming from the publication of material that violated an individual’s privacy rights. The issue in this case was whether the tanning salon’s disclosure of its customers’ fingerprints to a single third-party vendor met the publication requirement of the policy. West Bend argued that the term required disclosure of information to the public at large, but the trial court and appellate court both disagreed, ruling that a publication can be found where data is shared only with one person, giving rise to a potential of coverage under the policy and requiring West Bend to defend. The West Bend case constitutes another victory for policyholders amidst the conflicting decisions across the country on what constitutes publication.

Charter Oak Fire Ins. Co. v. Zurich American Ins. Co., No. 19-cv-4212, 2020 WL 1989399 (S.D.N.Y. April 27, 2020)

A recent decision out of a New York federal court is among the first to interpret a 2013 addition to ISO’s additional insured endorsement which provides that the coverage afforded to the additional insured “will not be broader” than that which the contractor was required to provide by contract. In this case, Charter Oak issued a CGL policy to a building owner, which also was insured under an additional insured endorsement issued to an elevator contractor. Charter Oak argued that Zurich was primarily responsible to defend the lawsuit, but Zurich relied on the “will not be broader” language in the endorsement to argue otherwise. The New York court ruled that the phrase refers to the contract between the building owner and contractor, which required the contractor to extend coverage to the building owner for any claims caused “in whole or in part” by the contractor’s negligence. Because such negligence was alleged in the underlying case, Zurich was required to defend. The decision serves as another reminder to construction policyholders to carefully draft and review their contracts as they relate to additional insured coverage.

G&G Oil Co. of Indiana v. Continental Western Ins. Co., 145 N.E.2d 842 (Ind. Ct. App. 2020)

A ruling this year from the Indiana Court of Appeals concerned an issue of national first impression among appellate courts in the area of cybercrime. In this case, the policyholder was a victim of a ransomware attack leaving its computer servers inaccessible. The policyholder paid four bitcoins ($35,000) in exchange for decryption passwords to regain access. The policyholder subsequently asserted coverage for the payment under the computer fraud section of its crime policy, but the insurer denied coverage. The lower and appellate Indiana courts ruled in favor of the insurer, finding that the bitcoin payments were not the result of fraudulent use of a computer. Rather, the court characterized the crime as theft, as there was no deception involved. Cybercrime policies have been prevalent in the industry for some time, and are widely noted as being written very specifically as to what they cover. Whenever policyholders are purchasing cyber insurance or submitting cyber claims, they are prudent to carefully analyze the coverage provisions and claim facts utilizing team members from their risk, legal, and IT departments, along with an experienced broker, to ensure all risks are addressed and all potentially applicable policies are notified.

Loya Insurance v. Avalos, 63 Tex. Sup. Ct. J. 969 (2020)

In the last of the cases highlighted in this article, the Texas Supreme Court adopted a collusive fraud exception to the state’s eight-corners rule for determining the duty to defend. The eight-corners rule provides that when determining the duty to defend, the court must only consider the four-corners of the policy and the four-corners of the complaint. In fact, within less than two months, the Texas Supreme Court again reaffirmed the eight-corners rule, rejecting an insurer’s attempt to limit the rule to where the insurer agreed to defend “no matter if the allegations of the suit are groundless, false or fraudulent.” State Farm Lloyds v. Richards, Texas Supreme Court Case No. 19-0802. In Avalos, however, the Texas Supreme Court allowed Loya Insurance to introduce outside evidence to prove that one of its policyholders committed fraud to secure coverage of an underlying personal injury suit. The high court found that the insurer had no duty to defend, adopting a “collusive fraud” exception to the eight-corners rule, although it stressed that the exception was narrow, and unless insurers have convincing evidence of fraud discovered early on, they should err on the side of caution and defend.

Share Article Via

A Fixed Attachment Point: Excess Insurer to Pay Long-Tail Claims Exceeding Policy Limits

In William Powell Co. v. OneBeacon Ins. Co., 1st Dist. Hamilton No. C-190199, 2020-Ohio-5325, Ohio’s First District Court of Appeals held that an excess insurer’s attachment point holds constant, in accordance with the terms of the policy, regardless of whether a policyholder purchases additional primary policies covering a long-tail claim. The court framed the issue as whether a policyholder is required to exhaust its insurance coverage vertically or horizontally.

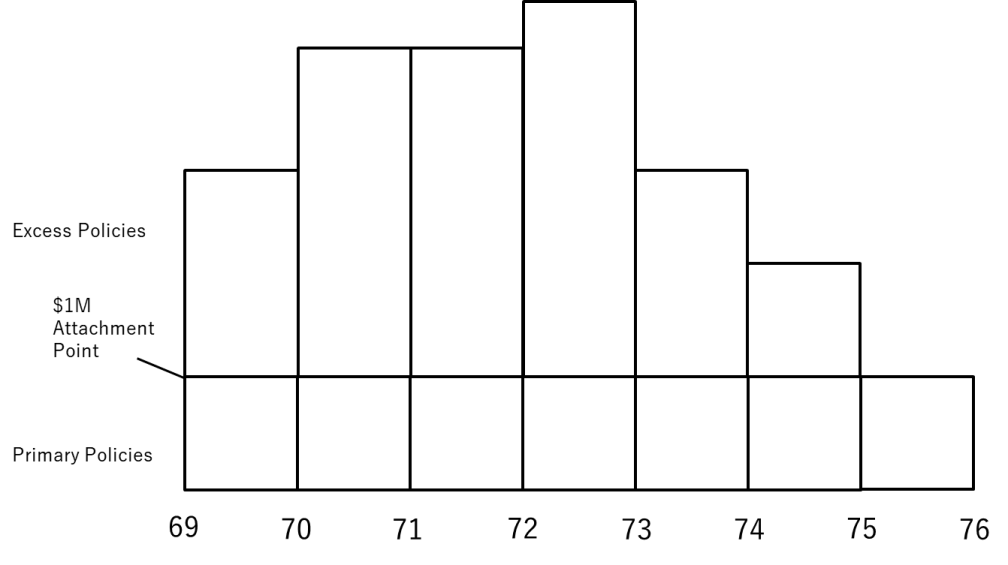

This framing is impossible to appreciate without first picturing a coverage chart—which is a graph that looks like a series of blocks stacked along an x and y axis. Each block is an insurance policy. The width of the block, running along the x-axis, represents the time the policy was in place; the length of the block, stretching up the y-axis, represents the coverage limits of each policy. The first layer of blocks represents the policyholder’s primary insurance policies. The blocks stacked on top of the primary layer are umbrella and excess policies.

Figure 1. Coverage Chart

Pointing to this picture in Figure 1, excess insurers will sometimes argue that, before a policyholder can recover against the excess policy, it has to collect from all the primary policies that provide coverage. This is called horizontal exhaustion.

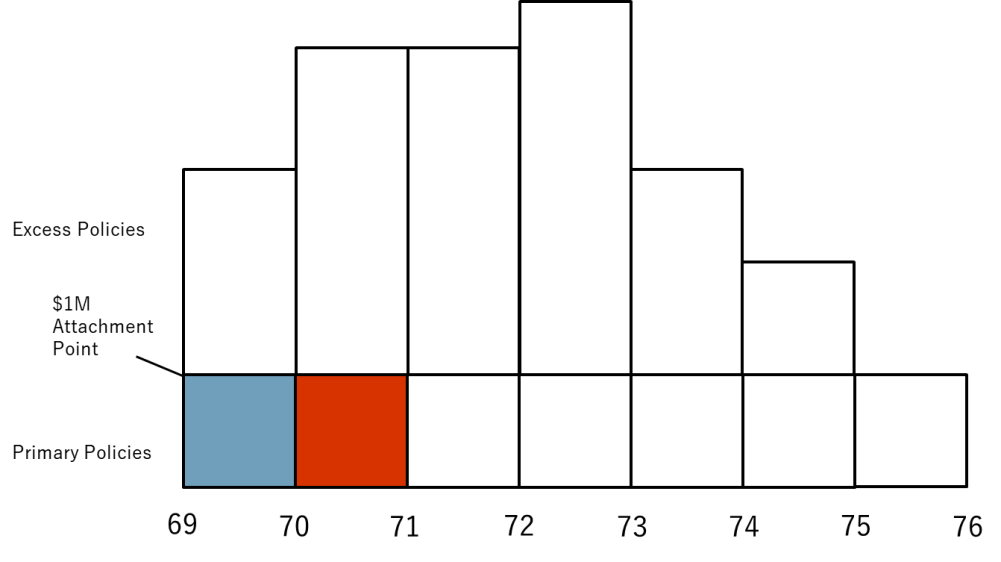

Figure 2. Horizontal Exhaustion

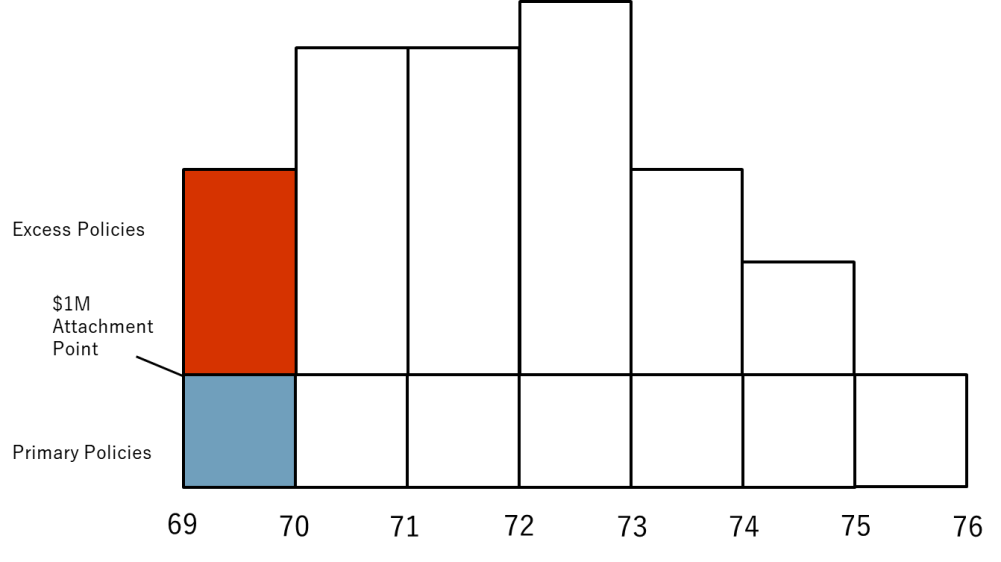

Policyholders push back, arguing that they only have to collect from the policies directly underneath the excess policy. This is called vertical exhaustion.

Figure 3. Vertical Exhaustion

Ultimately, though, vertical exhaustion and horizontal exhaustion are dueling approaches to interpreting a coverage chart, not an insurance policy. No excess policy mentions exhaustion—vertical, horizontal, or otherwise. Instead, excess policies normally say something to the effect that they will pay losses that exceed the limits of “underlying insurance.” The total underlying limits of an excess policy is referred to as that policy’s “attachment point”—i.e., the point at which the excess policy begins paying.

Returning to the coverage chart, the attachment point is the line where the excess policy rests on top of an underlying insurance policy. Horizontal exhaustion, in effect, is an attempt to raise this line.

Take as an example an excess policy with an attachment point of $1 million. In the normal course, that excess policy will pay the next dollar of liability over $1 million, plus every dollar after that, up to the excess policy’s limit. But, if the policyholder is required to horizontally exhaust its coverage, then the next dollar of liability is not paid by the excess policy. It is paid, instead, by the next primary policy. So, in essence, the attachment point of the excess policy is no longer $1 million. It is $1 million plus the combined limits of every underlying policy that might be triggered by a long-tail claim.

There is nothing in the language of most excess policies, however, that would permit an insurer to raise its attachment point. The court in William Powell correctly held that excess insurers are required to pay losses that exceed the limits of underlying policies covering the same policy periods as the excess policy. This holding is helpful to policyholders, who can rely on it to press excess insurers to pay more quickly for long-tail claims spanning multiple policy periods.

Share Article Via

Contaminants of Emerging Concern and Insurance Coverage

There is general familiarity with some chemicals and the risks these chemicals pose to human health and the environment. If trichloroethylene (TCE) is present in soil or groundwater at a former industrial site, the potential risks of exposure and associated liabilities are commonly understood.

TCE, along with vinyl chloride and dioxin, are just three examples of common chemicals regulated under federal and state environmental laws. But, have you ever heard of PFAS (per- and polyfluoroalky substances) or 1, 4 dioxane? PFAS and 1, 4 dioxane are examples of contaminants of emerging concern, or “emerging contaminants.” While neither of these two chemicals are “new,” they are part of a class of chemicals that had historically been unregulated, and not classified as “hazardous” under federal or state laws. However, as knowledge of the health risks associated with contaminants of emerging concern develops, so has federal and state regulation. With the increase in regulation, policyholders and their advisors should understand what contaminants of emerging concern are and be aware of the types of insurance coverage that might be available for the costs of investigating or remediating an environmental impact caused by these contaminants and to cover potential third-party claims.

What are emerging contaminants?

Contaminants of emerging concern form a broad category of chemicals or materials that are characterized by a perceived, potential, or real threat to human health or the environment, or by a lack of published health standards. These chemicals or materials are generally widespread, persistent in the environment, and generally not regulated. Many chemicals and materials considered to be a contaminant of emerging concern have been in use for decades, yet the health risks of such chemicals or materials are only now becoming known.

The group of contaminants of emerging concern currently receiving the most attention are PFAS, a family of nearly 5,000 man-made chemicals. PFAS have been extensively manufactured and used worldwide since the 1950s. These chemicals have unique physical and chemical properties that include repelling water, acting as a surfactant, and repelling oil. PFAS have been used in food packaging, household products such as water and stain repellent fabrics, non-stick products, waxes, paints, and even certain firefighting foams. There has been an increase in regulations of PFAS, particularly related to drinking water standards.

Another contaminant of emerging concern that is seeing increased regulation is 1,4-dioxane, a synthetic industrial chemical used as a stabilizer in certain chlorinated solvents. The chemical 1,4-dioxane is likely found at many sites contaminated with certain chlorinated substances because of its widespread use as a stabilizer for solvents. According to the U.S. EPA, as of 2016 1,4-dioxane has been identified at more than thirty-four National Priority List (NPL) sites and presumed to be present, but not tested for, at additional sites.

Pesticides (such as Glyphosate), pharmaceuticals, nanomaterials, perchlorate, and brominated flame retardants (BFRs) are also contaminants of emerging concern. All these contaminants of emerging concern pose a risk to human health and the environment. Although there is little regulation of these contaminants, the federal government is beginning to implement guidance and regulations that require monitoring and remediation of some of them under existing regulations such as Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), The Resource Conservation and Recovery Act (RCRA), and the Safe Drinking Water Act. Many states are moving to regulate PFAS substances as well. Both Michigan and New Jersey have enacted rules creating some of the nation’s most comprehensive and strictest regulations setting standards for PFAS in drinking water. Ohio has developed an action plan to address this as well, however, without enacting any standards of its own. As this shows, regulation is not widespread on a national scale, so there are different requirements depending on location.

Policyholder considerations

Environmental liabilities related to contamination caused by a contaminant of emerging concern may arise under various circumstances. A policyholder could place itself in the chain of title by acquiring property that might have the potential for soil or groundwater contamination and become a potentially responsible party for the environmental impacts at the site. A policyholder could face liabilities for environmental conditions related to its use or disposal of products that may contain or be a contaminant of emerging concern. The bulk of enforcement, whether it be third-party litigation or government investigations, has been directed at product manufacturers. Since there was no regulation of contaminants of emerging concern historically, when manufacturers used them, they were typically not treated prior to being discharged into a water body, often emitted directly into the air, or disposed of at a landfill not adequate to protect against the release, creating a long list of potential environmental liabilities.

Regardless of the particular circumstance of the policyholder, careful scrutiny is required to determine whether there is insurance coverage available.

Types of coverage that might be available

Potential coverage for environmental impacts related to contaminants of emerging concern could exist under comprehensive general liability policies or pollution legal liability (PLL)insurance. The type of insurance needed to cover liabilities related to contaminants of emerging concern will differ depending on the situation. If an insurer is currently manufacturing or selling products that contain such a contaminant, a thorough evaluation of available policies and potential risk exposures will need to be done to ensure risks of liability from a government-ordered investigation or third-party claim are covered. The policyholder should understand what the contaminant of emerging concern at the property is and the timeframe in which the damage to the property occurred. Once there is an understanding of the potential exposure risks, the next step is to assess the types of insurance coverage available. Performing a historical analysis of the policies available will allow the policyholder to determine whether there could be coverage under a CGL policy that does not contain a pollution exclusion (pre-1985 policy). This type of analysis will also assist in determining if PLL insurance should be considered. A PLL policy could offer more comprehensive coverage, especially since the risks associated with contaminants of emerging concern are still developing and there is limited regulation, therefore, there is less of a chance of a specific exclusion being included in the policy. A PLL policy can manage pollution liability risks associated with on- and off-site remediation expenses and third-party liabilities, as well as known pollution conditions in contaminated property transfers.

Takeaways:

- Know which contaminants of emerging concern might affect you;

- Evaluate both current and historic coverage available; and

- Consider adding a pollution legal liability policy to cover certain risks, especially for property transfers.

Share Article Via

Ohio Court Recognizes Coverage for Opioid Claims

Widespread addiction to opioid medications has led to a national health crisis. Governmental entities, such as states, cities, and counties, have incurred enormous costs in dealing with this crisis, including costs for medical response, intervention, and treatment. These governmental entities have asserted claims for these costs against companies in the stream of commerce for these medications, including manufacturers, wholesalers, distributors, and pharmacies. Huge settlements and verdicts have resulted from governmental lawsuits over these claims, some in the hundreds of millions or billions of dollars.

The companies sued in these cases have looked to their general liability insurers for defense and indemnity. Insurers, however, much as they did in response to earlier waves of expensive liability claims—such as asbestos or environmental claims—typically have denied the claims, at times without any apparent regard for the claim merits. Coverage litigation has ensued nationally. Courts are beginning to weigh in on the coverage issues, although there have been very few decisions to date from appellate courts.

In June of this year, Ohio’s First Appellate District, deciding a case from Hamilton County, weighed in on two significant opioid claim coverage issues, deciding both in favor of the policyholder, a pharmaceutical wholesaler. In Acuity v. Masters Pharmaceutical, Inc., C-190176, 2020-Ohio-3440, the court reversed a trial court decision in favor of the insurer. The appellate court rejected the insurer’s arguments that defense coverage under the subject policies was barred because (1) governmental expenses in the nature of economic loss were not covered and (2) the “prior-known-loss” provision in the policies operated to bar coverage. Brouse McDowell represented the policyholder in the appeal.

In regard to the insurer’s “economic loss” argument, the court noted that the policies at issue required a defense of claims for legal liability “because of bodily injury” and that “bodily injury” was defined to include “bodily injury, sickness, or disease.” The policies also expressly covered damages “claimed by any person or organization … resulting at any time from the bodily injury.” The court held, therefore, that “the policies expressly provide for a defense where organizations [such as governmental entities] claim economic damages, as long as the damages occurred because of bodily injury.” The court noted that the underlying governmental claims included claims for “medical expenses and treatment costs.” The court also noted that the governmental entities were not seeking bodily injury damages on behalf of their citizens, but this did not matter. As the court noted, “the governmental entities [were] seeking their own economic losses ….”

Regarding the insurer’s “prior known loss argument,” the court considered policy language that barred coverage when the policyholder “knew, prior to the policy period, that the bodily injury … occurred ….” The court stated, “The underlying suits claim that an opioid epidemic existed prior to 2010,” which was the inception year of the first policy at issue. The court, however, declined to equate knowledge of an opioid epidemic, if such knowledge existed, with knowledge of the specific bodily injuries involved in the underlying governmental lawsuits. In ruling in favor of the policyholder and finding defense coverage, the court reasoned as follows: “We agree that [the policyholder] may have been aware there was a risk that if it filled suspicious orders, diversion of its products could contribute to the opioid epidemic, thus causing damages to the governmental entities. But, we hold that mere knowledge of this risk is not enough to bar coverage under the loss-in-progress provision.”

At present, therefore, policyholders in Ohio asserting coverage for opioid liability claims can cite to a very favorable precedent. As the law on these issues develops nationally, policyholders across the country can do so as well. At the time of this writing, the insurer in this Ohio case is seeking review of the appellate court’s decision by the Ohio Supreme Court. If the Supreme Court should accept the case, there may be a further determination on these issues.

Share Article Via

Ohio Supreme Court Preserves Policyholder Allocation Rights

For insurance coverage claims that span multiple policy periods, sometimes referred to as “long- tail” claims, Ohio law, for decades, has permitted policyholders to pick and choose from among the triggered coverage periods, obtaining their insurance recoveries from the policy or policies of their choice. This right is referred to by many names, including “pick-and-choose,” “joint-and-several insurance liability,” and “all sums” coverage.

In April of this year, the Ohio Supreme Court, in Lubrizol Advanced Materials, Inc. v. National Union Fire Insurance Co. of Pittsburgh, P.A., Slip Op No. 2020-Ohio-1579, considered this right in the context of general liability policy language that provides coverage for “those sums” for which policyholders are legally liable, as opposed to “all sums” for which policyholders are legally liable. The Court recognized the right of policyholders to pick and choose their coverage for long-tail claims under policies containing “those sums” language, just as the Court earlier had recognized that right under policies containing “all sums” language.

This right is exceptionally valuable for policyholders relying upon Ohio law. It may permit policyholders to obtain full recoveries for long-tail claims when they lack coverage in one or more triggered periods because of insurer insolvency, policy exhaustion, problematic exclusions, or many other reasons. In such cases, policyholders can simply choose their best coverage year or years and allocate their claims to that year or those years. For policyholders, this allocation approach is far superior to the approach advocated by insurers, which requires long-tail claims to be pro-rated among all triggered years, leaving policyholders uninsured to the extent claims are allocated to years in which there is no effective coverage. States around the county are split on this issue, with a substantial minority of jurisdictions adopting the insurers’ pro-rata allocation approach.

The Supreme Court of Ohio first adopted the “all sums” or “pick-and-choose” allocation approach in 2002 in Goodyear Tire & Rubber Company v. Aetna Casualty & Surety Co., 769 N.E.2d 835 (Ohio 2002), an environmental insurance recovery case in which Brouse McDowell represented the policyholder. The Court then confirmed Ohio’s application of this allocation approach in 2010 in Pennsylvania General Insurance Company v. Park-Ohio Industries, 126 Ohio St.3d 98, 2010-Ohio2745, an asbestos insurance recovery case in which no policyholder participated but Brouse McDowell advocated policyholders’ interests through an amicus curiae brief filed on behalf of many Ohio-related companies. Both cases, however, concerned coverage grants that contained the “all sums” phrasing, rather than the “those sums” phrasing.

The Lubrizol Advanced Materials case decided earlier this year concerned losses arising from Lubrizol Advanced Materials supplying of allegedly defective resin that was incorporated into pipe that failed in many applications and locations over an extended period of time. Brouse McDowell represented amicus curiae parties supporting the policyholder’s position. The insurers asked the Court to adopt a pro-rata allocation approach, rather than the pick-and-choose allocation approach the Court had adopted in the Goodyear and Park-Ohio cases, because the policy at issue provided coverage for “those sums” the policyholder was legally obligated to pay, rather than “all sums” the policyholder was legally obligated to pay.

The Court, however, declined to do so, holding instead that in cases which “involve long-term or progressive injury or property damage,” the “all sums” or “pick-and-choose” allocation approach would continue to apply, regardless of whether the coverage grant at issue referenced “all sums” or “those sums.” The Court determined that Lubrizol’s ability to pick and choose the policy from which it would recover would depend upon whether Lubrizol’s claim “involved ongoing, continuous exposure,” which the Court described as “progressive injury.” The Court declined to answer that question in Lubrizol’s particular case, in effect returning the case for ultimate determination to the federal district court that had certified the question to the Ohio Supreme Court.

The Court went on to state that if “harm is discrete, not ongoing or continuous,” such that “coverage is triggered at a single, discernible point in time,” then the policyholder will be limited to recovering under the policy in place during that discrete injury. That, however, was not a departure from existing law. The Court, therefore, in effect reaffirmed the vitality of its Goodyear and Park-Ohio precedents, regardless of whether the coverage grant at issue references “all sums” or “those sums.” This is good news for policyholders relying on Ohio law.

Share Article Via

Ohio Court Rules in Policyholder’s Favor on Scope of Pollution Exclusion & Settlement Credits

The breadth and applicability of an insurance policy’s pollution exclusion is a frequently litigated, and potentially dispositive, issue in many insurance cases. Similarly, policyholders in claims where multiple insurers’ policies are triggered are also frequently confronted with arguments by non-settling insurers who assert they are entitled to a credit from settlements the policyholder reaches with other settling insurers. In R.W. Beckett Corp. v. Allianz Glob. Corp. & Spec. SE, No. 1:19-CV-428, 2020 WL 1975788, at *1 (N.D. Ohio Apr. 24, 2020), the United States District Court for the Northern District of Ohio ruled in the policyholder’s favor on both issues.

R.W. Beckett concerned a policyholder’s claim for coverage under its CGL policy for liabilities arising from asbestos claims asserted by furnace repair professionals who claimed to have been exposed to asbestos when servicing furnaces or boilers incorporating gaskets supplied by R.W. Beckett. The defendant insurers asserted that coverage was unavailable because of the policy’s pollution exclusion, which excluded claims “arising out of the discharge, dispersal, release or escape of smoke, vapors, soot, fumes, acids, alkalis, toxic chemicals, liquids, or gasses, waste materials or other irritants, contaminants or pollutants into or upon land, the atmosphere or any water course or body of water; but this exclusion does not apply if such discharge, dispersal, release, or escape is sudden and accidental.”

After R.W. Beckett reached a settlement with one of the defendants, a non-settling insurer also asserted a right to “settlement credits” resulting from R.W. Beckett’s settlement. This argument was premised upon the assumption that, absent credit for these settlements, R.W. Beckett would receive a “double recovery” if it also recovered under the non-settling insurer’s policies.

The insurer, FFIC, sought to have both the pollution exclusion and settlement credit issues certified to the Ohio Supreme Court, arguing that they were issues of first impression under Ohio law. The Northern District of Ohio declined to certify the issues to the Ohio Supreme Court, and further denied FFIC’s motion for summary judgment, finding that FFIC had failed to demonstrate an absence of material issues of fact as to both issues.

Regarding the pollution exclusion, R.W. Beckett did not dispute that the asbestos exposure arose from a “discharge,” “escape,” or “release.” Nor did R.W. Beckett dispute that asbestos would constitute “toxic chemicals, liquids, or gasses, waste materials or other irritants, contaminants or pollutants.” And, the district court held that even if R.W. Beckett had disputed either of these issues, it would have ruled in FFIC’s favor on both.

Instead, R.W. Beckett contended that the asbestos exposure did not result from a release or discharge into the “atmosphere” because the exposure was confined to the basement or residence in which the furnaces or boilers were located. After surveying various cases addressing the question, the district court held that the term “atmosphere” as used in the policy “is ambiguous with regard to whether it includes the air in a residential basement.” The district court further found that there was no evidence of the parties’ intent to exclude such claims, and that “the court must conclude that the parties intended ‘atmosphere’ to mean the air in the external environment and not the air in a residential basement or otherwise enclosed within a structure.” Thus, the court held that exclusion did “not clearly bar coverage for the asbestos claims underlying this case” and denied FFIC’s motion for summary judgment.

On the question of settlement credits, the district court found that it was an open question as to whether settlement credits would be available to non-settling primary insurers. However, the district court found that it need not certify this question to the Ohio Supreme Court because FFIC failed to carry its summary judgment burden on the doctrine’s applicability. Citing Goodrich Corp. v. Commercial Union Ins. Co., 2008-Ohio-3200, at ¶¶38-39 (a case litigated by Brouse McDowell), the district court held that “to show that settlement credits should be applied, the carrier must prove that the policyholder would receive a double recovery in the absence of settlement credits by demonstrating that the compensation paid by the settling carrier was for the ‘same damages’ underlying the claim against the non-settling insurer.”

Reviewing R.W. Beckett’s settlement with the settling insurers, which encompassed claims for past costs, the district court held that FFIC had failed to show that the remaining claims were for the “same damages” as the settled claims. Specifically, the remaining claims against FFIC concerned payment for ongoing and future asbestos claims. Accordingly, the district court denied FFIC’s motion for summary judgment on this issue.

The decision in R.W. Beckett demonstrates the value in challenging the sufficiency of an insurer’s summary judgment evidence, which often is insufficient to justify a ruling in the insurer’s favor. This decision further underscores how ambiguity in an insurance policy’s language often compels a ruling in the policyholder’s favor, particularly when the language is included within an exclusion.

Share Article Via

What to Expect When You Are Renewing

The insurance industry cycles through availability expansion and contraction resulting in either hard or soft markets. There is no dispute we are in a hard market – meaning that we have contracting availability resulting in higher insurance premiums, more strict and scrutinized underwriting criteria, reduced capacity, and less competition among insurance carriers.

In 2019, the market was already tough as a result of increased Catastrophic (CAT) claims (wildfires, tornadoes, flooding, hurricanes, blizzards and earthquakes, etc.), high verdicts, reduced interest rates (preventing insurance companies from increasing their profits by investing in other markets with the premiums), and reinsurance (to spread the risk) becoming more expensive. Now, add the pandemic and the market has hardened even more.

So, in this environment, what should we expect during renewals?

Property

In 2019, due to the increase in CAT claims, we saw increased premiums, more exclusions, more sub-limits, and outright refusals to provide coverage in certain high-risk locations. Those trends continued in 2020. Policyholders, even with good loss history, are seeing double digit increases in premiums, and CAT-exposed losses could see increases of over 50%. Additionally, carriers are issuing non-renewal notices for unprofitable insureds; increasing deductibles; closely scrutinizing buildings that are or were, partially or temporarily unoccupied, due to the pandemic; and attempting to reduce their capacity to less than 100% of the risk.

Employment Practices Liability

The #MeToo Movement evolved from increased sexual harassment claims to equal pay claims. On top of that, COVID and allegations of unsafe work environments (including class actions) means we should expect this market to continue to harden. Rates, retentions, and stand-alone claim-specific policies (like Wage & Hour policies) will likely increase. And, with the workforce coming back, expect increased scrutiny by underwriters on return-to-work plans, Wage & Hour compliance, and implementation of the Department of Labor’s (DOL) new overtime rules.

General and Umbrella Liability

Policyholders should expect additional exclusions: virus, odor, pesticide, sexual molestation, drones, vaping, opioid, marijuana, and wildfires. The shrinking umbrella capacity has led to reduced available limits, increased premiums, reduced capacity, and attempts to transition policies to claims-made.

Automobile

You would think this market would be stabilized with less people on the road in 2020, but commercial automobile losses have actually increased. We should expect underwriters to scrutinize safety programs and encourage the installation of safety technology on commercial vehicles.

Environmental

There is capacity and competition among insurers in this market allowing rates to stabilize for site pollution and contractor pollution coverages. Expect additional underwriting scrutiny and reduced terms for mold, petroleum and chemical operations, and aged industrial sites. Certain sectors may have premium increases and reduced terms: healthcare, redevelopment, and hospitality.

Representations and Warranty Insurance

Finally – some good news. There is significant capacity in this market. The rates are remaining steady; however, many insurers are requiring more time and effort in the due diligence process – specifically as to financials, cyber risk, employment practices, and tax indemnity offerings.

Overall Trends

If you haven’t guessed it yet, nearly every policy will have a COVID/virus related exclusion. Also, technology is transforming the industry. From drones utilized during property walk-throughs and apps streamlining the underwriting and claims process, to automotive safety tracking devices, and the capability to predict damage based upon weather indicators in your area. We should expect this dynamic year to be a catalyst for more technology use in evaluating risk and losses going forward.

What Should I Do?

Hold tight. Markets are cycles, and this will pass. In the meantime, you can bolster your chances at a better renewal by doing the following:

- Review Your Portfolio: Find out where you are missing coverage and may want new products on the market. With a hardening market, you may have less control over the terms and conditions, exclusions, and premiums, but you should always know what is and is not covered under your program.

- Increase Risk Assessment and Management Efforts: Know your losses and loss history and be prepared to discuss with the underwriter how those losses have been addressed by the company. Draft and revise policies and procedures to reduce loss going forward.

- Budget: This will be a tough cycle that will not soften in 2021, so plan ahead.

- Communicate and Retain a Knowledgeable Broker: A good broker, who knows your business, losses, and risks, can identify potential risks and appropriate products available.

- Start Early: The renewal process is likely to take longer. Underwriters are examining more issues, trends, and loss history. And insurers are waiting until the last minute to issue proposals.

Share Article Via

Attorney Highlights

Stacy RC Berliner and P. Wesley Lambert named Co-Chairs of the firm’s Litigation Practice Group in January.

Christopher J. Carney and Andrew W. Miller elected to their first term on the firm’s Executive Committee in January.

Amanda M. Leffler elected as Vice-Chair of the Leadership Akron Board of Directors, and elected to the Greater Akron Chamber Board of Directors.

David Sporar named to The Legal Aid Society of Cleveland’s 2020 “Partners in Justice,” in recognition of his role as an ambassador to his law firm and the legal community in Northeast Ohio.

Joseph K. Cole named a Fellow of the American Bar Foundation in July, and appointed to the Advisory Council on Diversity Initiatives for the Ohio State Bar Association in August.

Kerri L. Keller appointed to the City of Hudson Charter Review Commission for 2020.

Amanda M. Leffler commented on class actions involving pandemic coverage in a Bloomberg Law article.

Paul A. Rose commented on insured’s successful appeal requiring insurer to defend opioid liability suits in a Law360 article.

P. Wesley Lambert issued a video alert and podcast “Policyholders Can Find Support for COVID-19 Business Interruption Claims in Unexpected Places.”

Amanda M. Leffler co-authored a client alert, with Nicholas P. Capotosto and Stephen P. Bond, titled “Necessity is the Mother of Invention – Checklist of Issues to Consider Before Reopening After COVID-19.”

Jodi Spencer Johnson wrote a blog “Ohio Supreme Court Answers What ‘Those Sums’ Means in an ‘All Sums’ World.”

P. Wesley Lambert wrote a client alert “Policyholders Find COVID-19 Property Coverage Ally in Pennsylvania Supreme Court.”

Joseph K. Cole wrote a blog “Ransomware Attack – Is Losing Data Considered a Physical Loss Under Your Insurance Policy?”

For more content from Brouse McDowell’s Insurance Recovery Practice Group, please visit brouse.com/insurance-recovery to see news, blogs, podcasts, client alerts, and upcoming events. Don't forget to check out the recording of our 2020 Insurance Coverage Conference by visiting: bit.ly/2020-IR-Conference and providing an email address for access.